|

BLOG:

2009-2010 Archive BLOG

BLOG

Archives 2007-2008

BLOG

Archive 2006

BLOG Archives 2000-2005

We've all seen some of those

other sites; their 'blog' started about six weeks ago and has maybe 12 posts.

Well, they've to start

somewhere...

Here at the CoinMine, we've been analyzing

things in quite a bit of detail for the past nine years; and we've been

spot-on more than a random roll of the dice

would indicate, since 2000!. Browse below through a few hundred

pages of

observations, picks, calls, diatribes,

rants, and raves and mine your own nuggets.

12.30.10 Metals Performance for the Year

2010 Metals performance.

Gold

%27.74

Silver

%80.28

Platinum

%18.08

Palladium

%96.77

12.29.10

Shovel Ready Jobs in

NYC!

Plenty of SHOVEL jobs available in New York City. Too bad the sanitation

union (the ones that run snowplows on garbage trucks)

has ordered a work

slowdown! This ensures they get more OT for shoveling snow (while they

are letting the garbage pile up).

When the snow melts, they then get

more OT to pick up the rotting garbage! Union tactics at their finest!

12.29.10 Money Laundering = Coin Cleaning

And

the Vatican cashed in on the action:

http://www.theglobeandmail.com/report-on-business/pope-to-issue-new-bank-norms-amid-probe/article1851709/

12.29.10

On Cleaning

Coins as a Public Service

“Quarters look

like sparkling silver bits.”

Cleaning clad

pocket change is fine, but NEVER clean your old silver or copper coins.

Scrubbed clad

(coins with no silver) don’t have any collectible value. However,

old coins that contain silver – especially those before

WWII has

collector premium – called numismatic value.

A cleaned coin

removes the natural patina, or original skin, off the coin – leaving a

much less desirable piece of numismatic history.

Numismatic coins

that have extra value due to rarity and condition can lose up to half

their value immediately once improperly cleaned.

You can find much

more about the nature of coin cleaning and conservation here:

http://www.coinmine.com/What%20You%20Should%20Know%20About%20Coins/Composition/Coin%20Chemistry%20and%20Cleaning.htm

12.29.10

Chromium 6 hubbub,

this will drive up Mining costs in NA

The EPA is moving

toward regulating Chromium +6 per both Safe Drinking Water Act and Clean

Water Act.

The US Army, via Corps of Engineers, has spent TENS of

MILLIONS fighting Cr regulations b.c. it is near impossible to

differentiate native

(background) Chromium from that created via

industrial process.

The EPA will

promulgate Maximum Contaminant levels per Safe Drinking Water Act. This

will cost water purveyors to add further remediation technology, which

will simply be passed on to potable water customers.

This story had

gotten traction in the trade.

http://www.awwa.org/publications/StreamlinesArticle.cfm?itemnumber=55808&showLogin=N

What is even more

disturbing – and NOT getting the deserved press/discussion - is the

current effort to establish numeric standards for Cr and other metals

via the Stormwater regulations. Specifically, NPDES elements for

municipalities via Phase II. Cities, and everyone conducting work in

the cities (contractor) will need to monitor (physical chemical samples)

in impacted areas to ensure metal content is not above arbitrary

standards.

The mining

industry works in areas that are, by definition, rich in metal-bearing

soils. How much extra money it will take to comply with Cr+6

monitoring is just a guess at this point, but will be a

real/fixed/increasing cost.

12.29.10

Brigus Gold Sell Off (BRD:AMEX)

Was off over 6%

earlier. Seems overdone IMO; now coming back up. No real news that

I can see. Strong support @ 1.88. Think it should continue

up to 2.35ish or so before a real possible decline…

12.29.10

Continental Army Depreciation Certificate

“This 6 percent

interest-bearing note was meant to account for the depreciation of pay

soldiers received while serving in the Continental Line. The note

offered the soldiers inflation protection, as the value of the note

would be set against the value of corn, beef, sheep wool and sole

leather if the value of continental currency dropped.”

Sometimes the NEW

note isn’t a better note…

The note was tied,

in part, to the increase in the price of beef and leather.

(see bottom of

page)

http://www.pmgnotes.com/news/viewarticle.aspx?NewsletterNewsArticleID=1024

On aside, anybody

catch the WSJ article two days ago regarding the death of the pork belly

futures market? Interesting piece!

12.29.10

Cost of Christmas - 1960

http://www.gti.net/mocolib1/prices/1960.html#1960holiday

A few lessons:

*Should have kept

a silver dollar, now worth over $30 FRN; an increase of 30:1

*Should have

bought the used 1951 Willys station wagon jeep for $150. TANGIBLE ASSETS

maintain value. Try to buy a 1951 Willys wagon now, TOUGH.

On ebay right now, there is not even one 1951 available. You can

buy 1953 wagon for between $1,700 (not running, parts car) and

$6,500 (about the condition of a used 1951 wagon would have been in

1960!) An increase of 43:1

Using the ration

of 30:1 as the standard cost of theft via inflation, one can measure the

increase in Cost and Value for a fairly wide range of goods.

Interesting stuff…

*Train set,

Lionel, "Santa Fe," 5 car with diesel engine, 24.66/est

This did not

increase at the inflation rate, over time. I just priced an

equivalent train set last month, cost $400 for only a 16.2 x factor

increase.

12.29.10 question authority?

Remember, if you

question the TSA charade (especially from a vantage of professional

knowledge and training), they will come to your house, steal your

possessions, and throw you in jail. This is why they hate us for

our freedom!

http://news.travel.aol.com/2010/12/23/pilot-in-hot-water-for-exposing-security-flaws

12.29.10

How Tax Hikes Destroy Jobs

Pretty hard to argue with this

in-depth analysis:

http://www.illinoispolicy.org/news/article.asp?ArticleSource=3613&utm_source=Illinois+Policy+Institute&utm_campaign=4893ce5c0a-Daily+Show%2FSun+Times+Media+Alert+4%2F20%2F10&utm_medium=email

12.17.10 Sold Corn for a nice profit.

12.21.10

Gifts to Kids - Not the

GirlScouts Administration

This year I stopped my

support of the Girl Scouts. They had sent a mailer highlighting

how they taught girls ‘environmental activism’ and a number of other

dubious pursuits, none of which aligned with their mission statement.

I excoriated their

philanthropy lead, and copied a third of their corporate board.

Only the philanthropy lead responded, with a half ass ‘that isn’t what

we meant’ garbage trough.

Forget them.

Better and more

deserving organizations out there!

Better off donating to a local

alternative school

Kinross Gold, actually, has been

making some very nice donations to education causes over the last couple

years. No fanfare, no press releases, very classy KGC.

I am rather impressed with their company they have built over the past 5

years, from many disparate parts.

12.17.10 Sold GoldCorps (GG) at about $44.45

12.3.10

Mono Lake Discovery - Bacteria that Live on Arsenic

More than that, they've built As

into their DNA!

Scientists (but not reporters)

have known for years about the existence of bacteria that make a living

on Arsenic.

This article from 2003 notes there are at least 16 different bacteria

that digest As.

http://www.thefreelibrary.com/Attack+of+the+rock-eating+microbes!+Some+bacteria+break+down...-a0110963009

For at least 25 years there has been evidence that certain bacteria

along the ocean hot vents were making a living off arsenic and heat.

One of the four largest remnants

of ancient Lake Lahontan which covered most of Nevada. These

lakes, like the rest of Nevada (and parts of Ca, Ut, Or) are part of the

Great Basin. This means there are no rivers which flow to the

ocean, all waters flow into basins, and evaporate. All these lakes

are outstanding places (Great Salt, Pyramid, Walker, Mono). Tahoe

is in the great basin, but is actually an alpine lake, since water flows

out of Tahoe (and ends up at Pyramid (and formerly in Lake Winnemucca).

Mono is one old body of water

(three quarters of a million years+) with an amazing salt soup.

There is a hot spring along the water’s edge. Closed to humans,

saved for the wildlife. (I’ve been in it but not a great spot;

especially with so many other awesome soaks nearby).

The colors of the adjacent

Sierra Nevada ridge at sunrise and colors playing upon the water at

sunset are unsurpassed. Great place to take a walk, beauty extends

for miles.

The lake’s unique chemistry and

resultant water color, and mountain surroundings provide for some

particularly beautiful plays of light.

So many photogenic scenes along

the lake that for many years there was an Ansel Adams photography studio

on the lake. Closed down six or seven years ago.

For many years an old motel

chalet and lodges stood empty, decaying across the highway. That

was my dream property. Was going to fix it up, put a wife in each

cottage!

Someone else fixed the place up

eventually

http://www.tiogalodgeatmonolake.com/

The Lake had been dying. All

five streams that feed her were diverted to L.A. About 10 years

ago the city and natural groups and the state finally came to an

agreement to keep enough water flowing into the Lake so that the island

in the middle could remain an island. (When the water level gets

to low the land bridge allows coyotes to reach the bird preserve).

Tuolumne Meadows (Yosemite);

Mammoth, and a host of other outstanding areas (and mining history) are

within 30-60 minute drive.

Definitely worth spending a

couple days there, if you have never been.

12.3.10 Two More Nevada Mining Towns will Return to

Dust (gypsum dust, actually)

http://www.rgj.com/apps/pbcs.dll/misc?url=/custom/empire.pbs

Gerlach is the gateway to the

Black Rock Desert. Great place to get some space!

12.1.10 Sold Half my UXG

12.1.11

The senate passed BY VOICE VOTE the newest set of burdensome regulations

These were

specifically designed to hamper the

small/local/organic farmer at the expense of the large agri-corps.

Yes,

the new law WILL make it harder to collect seeds, and penalize those

that do not purchase GMO seed. Read here why Monsanto, Archers

Daniel Midland, and those adding the GMO and poisons to your food

SUPPORTED this bill and paid off the Senate to pass.

http://www.csmonitor.com/USA/Politics/2010/1123/Food-safety-bill-101-What-are-the-facts-and-myths

11.24.10

When a Corporation Controls too much of Its Supply Chain

From

what I have seen a corporation that controls/owns their vendors and

suppliers can prosper over the short term, but lose over the long term.

If a

corporation controls the vendor, the corp will ensure the vendor

supplies EXACTLY what they want, to their specs, on their timeline, to

fit their needs only. Since the corp gets what they need, they

improve efficiency and profit.

However, if that vendor does not supply any other firm, how will the

vendor learn the advances in the sector/industry? They won’t!

Also,

if the specifications are rigid, how will the vendor introduce changes

that will improve the project? They won’t!

So in

the long term, the vendors and corp are on the same boat. No new

thinking, no new developments, no breakthroughs – just groupthink.

Looks like part of what took down GM/ACdelco.

Good

idea to learn how to value corporations. Lots of successful fundamental

trades made by comparing stock price to underlying corp book priced.

11.21.10 TSA Molestation of the

Citizenry

Remember how TSA stated in public releases that the body

scans COULD NOT be released because they would not be saved?

(Well, at least *I* remember that)

They lied about this, just like they lie about every thing

else.

For a start, here are 100 saved and released images:

http://gizmodo.com/5690749/these-are-the-first-100-leaked-body-scans?skyline=true&s=i

Hey, you ever wonder why Israel DOES NOT DO THIS?

Don't they have a bit more experience with this terrorism thing?

How come they aren't setting up a complete police-state apparatus?

Answer: Because the system is NOT designed for safety, it is designed to keep

you compliant with the military-security police state.

And the fools clamor for more!

'Give us Iris Scans for expediency'

'Molest our children for safety'

'Perform cavity search on my wife for our freedom'

NOW you know what it feels like to live in Germany, 1938 or Cuba 1958 or China

1966. The people cried out for even more government control and they reaped what

they sowed...

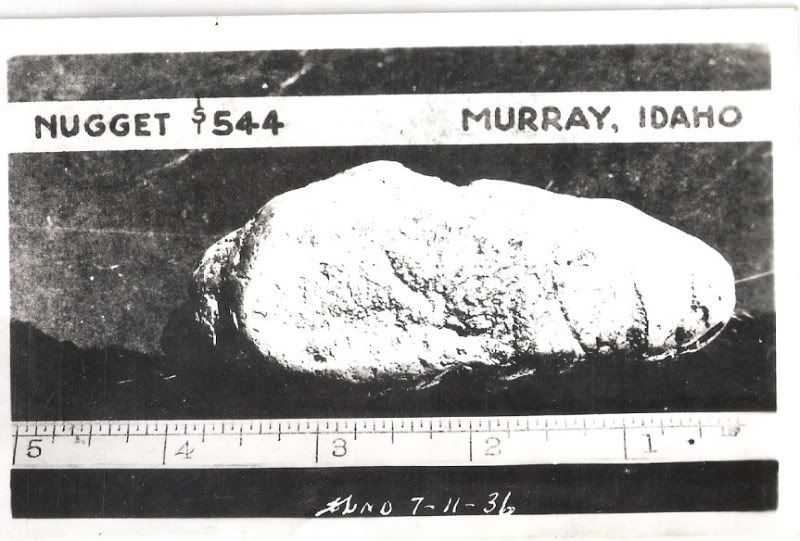

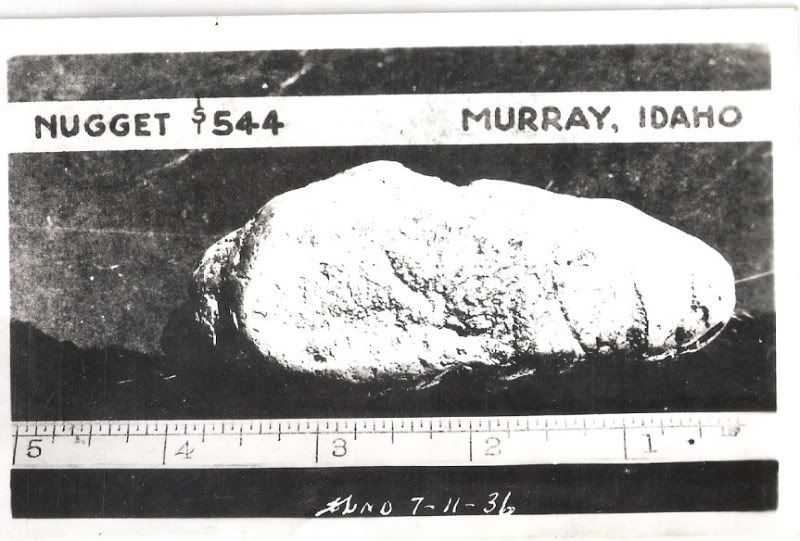

11.21.10 One of the Largest Gold Nuggets

in the US Sold

http://www.rgj.com/article/20101121/NEWS/101121007

Hope the new buyer allows visitation rights!

Read what the doofus casino manager says - 'Wasn't drawing

the public interest anymore'.

Yep, that's because the Casino kept the same small,

obfuscating, display case since the 1970s. The Golden Nugget is located

next to a gold-coin focused coin store and across the street (sorta) from the

Carson City Mint (Museum). A little marketing could have gone a long way

to drawing traffic and public interest. Too bad, I always enjoyed viewing

this collection on my way to the craps table. They neglected the

collection so badly, never even cleaning the class so one could take a decent

picture.

Regrettably, poor management has been driving this casino

into the ground. I give them another 18-24 months before they close their

doors.

The other largest gold nugget collection in the US, displayed

at the mineral museum in Mariposa, really is worth the visit on your way into

Yosemite.

11.20.10 Interesting survey on expats

living abroad, satisfaction with new host country

https://www.hsbc.com/1/2/newsroom/news/2008/hsbc-survey-reveals-best-expat-locations

USA actually ranked much higher than I thought! For as bad as

america has declined

I can't get past the fact that

immigrants are still arriving here FROM other place. Sure, the pace has

slowed down from what it was six years ago, but the pace of inflows has

always varied.

I've known quite a few expats that tried Nicaragua, Belize, Ireland,

Thailand, Mexico, Australia, Vietnam, France, Germany, Scotland, Costa

Rica, Argentina, Caymans and Jamaica.

I do know US expat community still growing in Brazil, Panama, Chile and

northern Italy. But the flow of volume still comes this way.

Rather dour to consider as bad as it's getting here for many folks, it's

even worse most everywhere else...

One of the

hardest factors for Amercians to adjust to

abroad is that the expats miss ice cubes and bowling

BINGO!

They miss the CULTURE, high or low.

Fact

is, the US is the dominant culture.

IF you

examine your life and surroundings, as obviously you have done, THEN you

will change your values much faster than the dominant culture. As

such you will no longer fit that culture and seek another more to your

new value system and liking.

That

search typically proves unfruitful, the grass is always greener, etc..

I

spent two months in Belize in 1991. One of the most beautiful

places I have been, that barrier reef, the Cockscomb mountains, the

savannah plains rolling to Tikal…

But I

missed not being able to have a cold drink, or play a game of pinball,

or 1,000 other little conveniences that we take for granted every day.

Eventually I realized by the previous dominant culture (Mayan) died off:

their surroundings were unforgivingly brutal.

Also,

as corrupt as we are – many folks still uphold the rule of law. I

have not found that the case through much of Latin America and Asia.

Even in 91 cocaine money ruled Belize.

About

five years later a family I was close with moved to Belize, sold

everything in Ca and ‘moved for good’. I gave them five years.

They

lasted three.

Switzerland, eh?

Ya!

If you have been given a year to live before dying of terminal cancer,

move to Basel. Boredom will kill you in six months, saving you

hospice…

11.20.10 Lincoln to Disgrace the US

Dollar Coin

http://www.collegenews.com/index.php?/article/us_mint_3984729875269229/

Why not, he disgraced the republic. Only fitting he should

represent the value of a dollar now being worth one cent!

James Buchanan, Franklin Pierce and Millard Fillmore ALL KEPT

THE UNION Together.

None of them saw fit to instill martial law under some bs pretext. Buchanan

proved himself an incredible statesman, as a little research proves.

Poor Lincoln, a soul so tortured he still roams the

presidential suite...

And every time I get the chance to provide a mini-lecture on US financial

history, he gets his comeuppance.

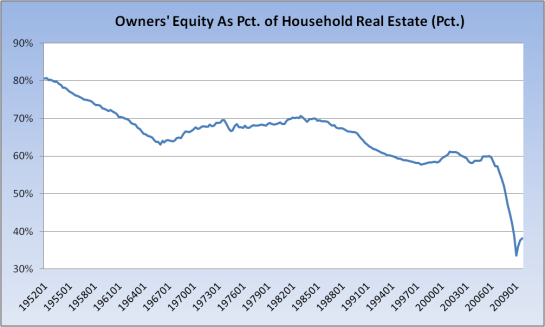

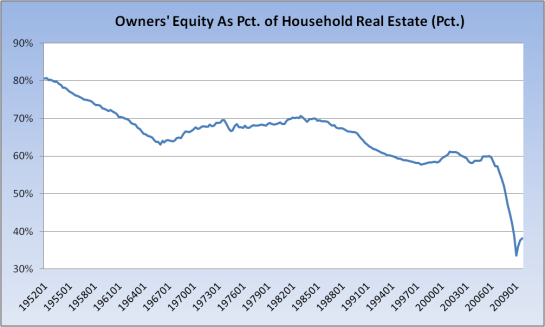

11.19.10 The End Result of a Fiat

Fractional Reserve Banking Debacle

11.19.10 The Jobs are NOT Coming Back

![[STARTUPS]](http://sg.wsj.net/public/resources/images/MK-BH706_STARTU_NS_20101118193803.gif)

Why is the investor money no longer flowing to the US?

Because the US governments dissuade investment via

unreasonable environmental regulations, red tape and taxes.

Pretty basic...

11.18.10

40 Years of Fraud, Theft and Lawbreaking

And Charlie Rangel gets a

'censure'. This means he loses the nice parking spot at the capitol building,

seriously. The man had 3Million$ in legal bills! How does this happen?

Well, he takes his campaign finance money, gives it to his lawyers (who skim 20%

off the top) and the rest goes to chuckles bank account in the Bahamas.

This is how politicians get rich...

11.17.10

So you Want to be a Real Estate developer?

Sometimes you

have to skip past the first couple intro chapters to see where all the

hard work is eventually leading. That is, rather than always focus on

the baby steps sometimes good to hear the big picture from one that has

‘been there, done that’.

I found this

talk rather enlightening; interesting that he *starts* with architecture

and occupancy rates…

Fast forward

through the introduction and start at minute 11 when the presentation

begins.

http://www.planbeconomics.com/2010/11/16/so-you-wanna-be-a-real-estate-developer/

11.17.10

Metals

and Stocks

kept selling off

Monday and Tuesday, as I mentioned they should. Silver is still the more

bullish of the metals, did not have the bearish divergence that gold did.

Still see

silver going down to 23 (convergence of the 50 day EMA and the middle

rail of the current trendlines); or $22.10 (bottom rail) or $19.25 (200

DEMA and bottom band support).

Still see

gold to $1,325; maybe more, with today as a sucker buy

But you never

know, staying in cash instead of metals has been a very poor strategy

for the past decade…

My sells had

much better margins of safety than the two spec buys; the buy volume has

been anemic.

11.16.10 The Political Favors Get

re-paid

You get the shaft. Here is just the start of union

groups and special interests with a 'waiver' from the 'Health Care Act'

http://www.hhs.gov/ociio/regulations/approved_applications_for_waiver.html

11.15.10 Google will get you to think

what THEY want you to think!

Har...

Really, I found a while back a need for a decent glossary that ties monetary,

mining, coins, trading together.

For example, if you just google (or use a better search index like dogpile or

ixquick that doesn't track and sell your queries) 'banjo', you will find all

kinds of 4 and 5 string entries.

Now don't get me wrong, I love the plectrum world and have an

Orpheum Number One banjolin myself, but google refers you to another cesspool of

lazy thinking - wikopedia.

The wiki agents have another mandated limited view of the

world.

The reality is, banjo also has three mining/geotechnical

meanings.

You could spend useless hours trying to get wikipedia/google

to tell you that.

So, I made my own useful glossary ( always a work in trial).

Hope you find it useful...

http://www.coinmine.com/Reference/Master%20Financial%20Glossary.htm

11.15.10 On Trading Rules

1. Monetary Philosophy determines a trading Philosophy

2. Trading Philosophy determines a Trading Focus (industry/sector)

3. Trading Focus determines the Trading System

4. Trading System Determines Trading Rules

The trader eventually and constantly tweaks and adjusts these rules to

fit their own predilection and experience. These rules morph into

decision points, mechanically implemented yet continually back tested.

The underpinning philosophy may change over time, demanding a change in

the focus (and in turn the systems and rules).

Here is a nice collection of various trading rules:

http://www.page88.co.za/cr/tradingrules_menu.shtml

Note that these rules generally flow from the two original trading rules

list. The first appeared in 1923, based upon Jesse Livermore’s

experience as published in Reminiscences of a Stock Operator by

Edwin Lefevre:

Of all the speculative blunders, there are few

greater than trying to average a losing game.

Always sell what shows you a loss and keep

what shows you a profit.

You cannot try to force the market into giving

you something it does not have to give.

The courage in a speculator is merely the

confidence to act on the decision of his mind

A loss never bothers me after I take it. I

forget it overnight. But being wrong – not taking the loss – that is

what does the damage to the pocketbook and to the soul.

The man who is right has two forces working in

his favor – basic conditions and the men who are wrong.

The trend is evident to a man who has an open

mind and reasonably clear sight. It is never wise for a speculator to

fit his facts to his theories.

In a narrow market when price moves within a

narrow range, the thing to do is to watch the market, read the tape to

determine the limits of prices, and make up your mind that you will not

take an interest until the price breaks through the limit in either

direction.

You watch the market with one objective: to

determine the direction of price tendency. Prices, like everything else,

move along the line of least resistance.

In the long run, commodity prices are governed

but by one law – the economic law of supply and demand.

It costs me one million to learn that a

dangerous enemy to a trader is his susceptibility to the urging of

magnetic personality combined with a brilliant mind.

Have a profit – forget it! Have a loss forget

it even quicker!

It was never my thinking that made the big

money for me. It was my sitting, my sitting tight.

There is only one side to the stock market and

it is not the bull side or the bear side, but the right side.

The second major list was developed by W.D. Gann in 1942:

Never risk more than 1/10th of your capital in one

speculation. ( * )

Use Stop Loss orders

Don't overtrade. ( * )

Never let a profit run to a loss.

Don't buck the trend.

When in doubt, get out.

Trade only in active stocks. ( * )

Spread risk among 4-5 issues - not just one.

Never fix your price, trade at market. ( * )

Don't close positions without a good reason.

Build an emergency fund.

Never buy to get a dividend.

Never average a loss.

Never get out because you've lost patience with a position.

Avoid taking small profits and big losses.

Never cancel a stop order once you make a trade.

Avoid getting in and out too often.

Be just as willing to go short as long.

Never buy because a price is low, or sell because a price is high.

Be careful about pyramiding at the wrong time.

Select stocks with a small volume of shares outstanding to pyramid on

the buying side, and the ones with the largest volume of stock

outstanding to sell short.

Never Hedge. Get out instead.

Never change a position without a good reason.

Avoid increasing your trading after a period of good trades.

Notice that these two canons of trading rules are actually rather

different!

Why?

Different Philosophy and thus different Focus (Stocks vs. commodities).

11.12.10 It Starts as a Cartoon

But becomes nightmarish reality in just days...

They Hate Us for Our Freedoms...

11.12.10 Metals Markets

Gold and Silver should correct quite a bit more IMO. If not,

the next move up could be very impressive indeed!

Gold has next decent support at $1,325. Gold outperformed most all the other

metals today, showing relative strength.

Silver can fall all the way to 23ish and still be in the powertrend up.

Same for both the DJIA and SPY, both are re-testing the very long term

trendline, from below. IF it turns down, turns down hard, if it breaks through –

potentially very impressive gains.

Sentiment and internals have turned down, though:

Copper is at a triple top.

XAU is at the top of a trendline going all the way back to

1990! Quite bearish. Similar to the hard metals, if it breaks through Katy bar

the door.

Note the weekly XAU printed ANOTHER higher high. Stokes and candlecharts point

down whereas macd and aroon in the positive.

My guess is momentum fades and XAU falls to 195ish, maybe lower BUT if it breaks

up through the trendline ANOTHER major buy signal.

IAG has that gap that will set resistance.

Hecla Insiders selling the crap out of it, just one example of many:

GSS (tanked this week on earnings) and CORN (not even close

to the run that Sugar and others have had) look the best here from a risk/reward

perspective, if you have cash to deploy IMO.

I have begun to sell a little more than usual for the short term, but the long

term should be up for hards, softs, equities due to Quantitative Easing II…

11.11.10 Recent Change to California

Regulations

Require that life insurance companies notify customers that

if the policy holder is considering a change in their policy, to consult with a

licensed insurance or financial advisor.

So, does this work in the Insurance Company favor or not?

Depends on if you consult an insurance advisor (salesperson)

or advisor - who should give quite different answers!

Politicians need to be seen as 'taking on' the insurance

industry over the past year.

Could be that the large NY brokerage houses are funding this

'advice' to shield heat from their obvious criminal activity?

11.10.10 The Joys of Silver

Humans have used silver for the

past twenty centuries because it is an effective antibacterial agent.

Remember silverware?

Silver cutlery replaced lead

since silver (Ag) is also non-toxic to humans (unlike lead) except in

ultra high doses, typically via intravenous injection or abnormally

persistent oral doses.

Today physicians use Silver sulfadiazine and

various nano-silver applications in bandages and burn creams for the

antibacterial/antifungal properties. There are dozens of other

medicinal applications.

Alcohol will lyse a bond (kill a

bacteria) but is of incredibly short duration since it will evaporate

within a minute; whereas silver delivered as a cream, gel or mist is

persistent enough to prevent bacterial colony growth after the initial

germs are killed.

It took us 2,000 years – but we

are back on track understanding the medicinal applications of silver.

In large part, the major pharma companies have demonized simple medical

applications in favor of their monopolistic patents. Their

stranglehold is fading though they pay a large array of admen to post

illogical and incorrect hit pieces on natural remedies proven over the

past 100 generations of humanity…

11.9.10 Solid Propellant Missile Launched

From Sea 35 Miles off Coast of Los Angeles

And the military/government ask us to believe

a) They don't know what it is (but nothing to worry about!)

b) Just common contrails from a plane (since you won't

believe the first B.S. answer)

Note: contrails do not occur at such low altitudes, one way

to tell the difference between chemtrails (or propellant exhaust) and vapor

trail

11.5.10 Hope That False Flag Bomb Attack

doesn't go Off Tomorrow Like Planned in the Simpsons Cartoon!

11.3.10 Ron Paul vindicated.

I first voted for Ron Paul for President of the USA in 1988.

If only a few more citizens were awake then we may have been able to prevent

some of the massive fraud and decay in our country. Alas, the blind snickered

and giggled, but usually just asked 'who'? Most folks could not even name

the six or seven parties that typically make every major ballot.

Time marched on, and the country further swirled down the

toilet. But Ron's stature grew. They realized he wasn't flashy, and

not even that great a politician. Just an honest man, doctor, husband father and

patriot. One that could explain the complicated financial madness in

layman's terms. By 2006 Ron Paul led many republican straw polls for

president. He actually won the more than one states' presidential nomination

when he ran again for president in 2008 His following grew immensely.

Today he was named chairman of the House Monetary Policy

Subcommittee.

Vindication at Last!

(p.s. His son was elected US Senator yesterday, if you needed

just a little more proof!)

11.3.10 The Nevada Election Was Fixed

In Nevada the state regulators have access to software that

controls the slot machines; non-registered software is illegal. The

diebold voting machine software is 'proprietary' information. Guess who

services the Diebold machines? SEIU technicians!

Nv Gaming inspectors have immediate and mandatory access to

NV slot machines. They can shut down malfunctioning or broken machines on

the spot. The state electoral commission has NO ACCESS to the

diebold machines.

Slot machine manufacturers are subject to background checks

and employees are investigated for criminal records. Diebold programmer

are anonymous!

Slot machines are certified by a public agency, all data

subject to sunshine laws. The diebold machines are certified by private

for-profit corporations who release no mandatory data!

In Nv, if there is a handling dispute on a slot machine

payoff the Casino MUST contact the government regulatory board who investigates

machine function and payout record. When the voter complains about a fixed

diebold machine, THERE WAS NO MANDATORY INVESTIGATION.

Read about the voters in Las Vegas who claimed Diebold

electric voting machines would register Reid before they even voted!!

The election was fixed. 9:5 true odds.

(And here's the kicker. Guess who certified the vote in

the most populous county in Nevada?

Rory Reid, Harry's son!!

11.3.10 Meet the New Boss

Same as the Old Boss

11.2.10 How to Calculate Price per

Earnings per Growth:

2010 Annual Earnings (Current

Year ending Dec 17): 6.30

2011 Annual Earnings (Next Year Dec 18): 7.49

Projected Growth (1 Year): (7.49-6.30)/6.30

= 19.62% growth year over year.

Note:

Just because the numbers that you calculate don’t exactly match

stockhouse or yahoo or etrade, so what? Yahoo et. al gets its data

feed from more than one source. One feed will provide one # and another

source feed will have a different one.

Think

how many different data points Yahoo has every day? Even if they are

only wrong 2% of the time that is a VERY large number of bad datum

points.

PEG is

a good metric for retail sales, not so much for other industries (such

as mining; other aggregate, etc).

In

retail sales, there is even a better forward indicator IMO – PES Price

per Earnings per Sale. Also like Price per Sales and Revenue per Sales.

Nothing happens until a sale is made.

For

example, retail restaurant chains are so flash in the pan (about a three

year sweet cycle) that you need to know if the sales continue to grow.

If not, WATCH OUT. Remember Boston Markets? Yeah, they were

REALLY hot for three years. Now Bankrupt. Black Angus Steak House?

Same thing.

Look

at the sales curve for those restaurant and add Applebees, PFChang's,

Round Robin, etc.

Now

overlay for the restaurant chain you are currently analyzing...

10.31.10 Rare Earth Metals – A Short

Primer

Rare Earth Metals (REE) are

elements, typically metal, that are required for high tech development

and manufacture of electronics, aerospace, military and similar

products.

Some examples include:

Molybdenum

Ruthenium

Lanthanum

Neobium

Tantalum

Cesium

Lithium

Cerium

Vanadium

Different analysts include

varying example in their REE basket. For instance some would

include Uranium while others would not.

Since REE are required for

military applications, the mineral stocks are strategic store – a very

competitive market exists for the rarest REE.

Extraction of these rare earths

are similar to precious metal mining with a few notable differences.

-

Whereas precious metal ores

have been sought out for a few thousand years, the REE have only

come into demand in the last 70 years (some of these elements were

only ‘discovered 100 years ago). This means that the mining

infrastructure (power, roads, water, and human resources) do not

exist where the ore bodies exist.

-

The mineralogy may require

different engineering and technology than have usually been utilized

on precious metals mines.

Some of these extraction

scenarios produce many more tons of overburden (waste rock) than

precious metal mining. This is a social and environmental aspect that

demands significant personnel resources and goodwill capital.

Here are a few popular blogs to

read about REE.

http://www.raremetalblog.com/

http://www.raremetalstock.com

NOTE: These sites may receive

financial subsidies by manufacturers/miners for product placement and

write-ups.

How to Invest In REE

Option One – Speculative: Stock

Picking.

This option requires the most

amount of due diligence and time and will typically only pay off for the

savvy. You will need to focus on a sector within the industry. For

example, if you look at the Uranium slice of the REE pie, you might find

choose to stick with the larger producers such as Denison, Cameco (CCJ),

etc.

Or, perhaps you want to allocate

some very speculative wagers into micro firms that may be on to the next

bid ore body and determine that Ucore or Fronteer, Uranerz (NYSE:URX) or

Paladin have promise:

When you become familiar with

current producers, and learn their ore bodies, at that point you can

begin to extrapolate from that ore body and predict which explorers in

nearby areas have higher likelihood of production. For example,

Uranium City in Saskatchewan might provide a more likely source of

future uranium deposit discovery than Chicago, right?

Option Two: The Funds

Pinetree Capital, PNPFF, has

multiple uranium stocks and is one of the very few funds with exposure

to the rare earths; the fund also holds potash and precious metal

portfolio.

http://pinetreecapital.com/investments/sectors/uranium/

Option Three: ETF

The Rare Earth Metal Fund (REMX)

just started trading.

DISCLAIMER: YOU MAY NOT KNOW

WHAT YOU ARE DOING AND WILL LOSE PROBABLY LOSE YOUR ASS, SO DON’T BUY

ANYTHING. PROVIDED AS INFORMATION ONLY.

(and I will buy REMX tomorrow)

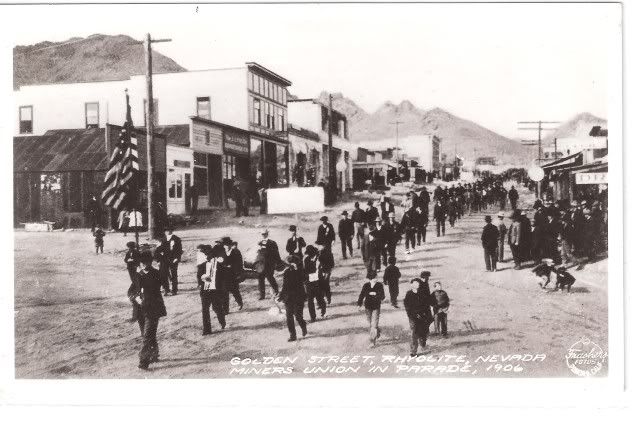

10.29.10 Happy Nevada Day

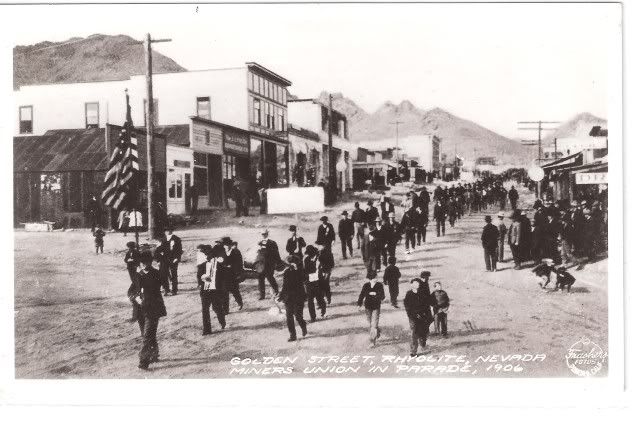

The Nevada Miners lived in some

far away places, for the time, and built civilization amongst the alkali

sagebrush scrub. Austin was just such one example:

[IMG SRC=http://i295.photobucket.com/albums/mm146/weepah/postcards2/AustinNvcirca1908jpg.jpg]

Once in a while, the miners

needed something to take their mine off another 10 hour shift under the

earth. They left a clue, a token, from one of their favorite past

times; this one from the greatest gold camp on the planet – Goldfield

Nevada!

[IMG SRC=http://i295.photobucket.com/albums/mm146/weepah/Tokens/TheDen125centtokenRSmall.jpg.jpg]

The camps of Goldfield, Tonopah

and Beatty were roaring in ’06.

In Rhyolite the miners flew

their flag high, showing their strength in numbers:

[IMG

SRC=http://i295.photobucket.com/albums/mm146/weepah/postcards2/RhyoliteMinersUnionMarchjpg.jpg]

Alas, they overplayed their hand

in Goldfield following the panic of 07.

The owners Wingfied and

(Senator) Nixon called upon their friend, Governor Sparks who sent in

troops.

The Wobblies (union) were broken

forever!

All that Nevada dore (gold)

Ended up somewere. Maybe a

piece in your pocket.

Before that stop, the gold took

a breather in the basement of the San Francisco Mint:

[IMG SRC=http://s295.photobucket.com/albums/mm146/weepah/?action=view¤t=SFMintCoinShow11609007.jpg.jpg]

10.29.10 Original Charlottes Web Cover

Art Sells for over $150,000

Estimate was only $20-30k

http://fineart.ha.com/common/view_item.php?Sale_No=5038&Lot_No=78301&type=artnews-tem102910

10.28.10 This Site has a Good Coin Melt

Value Calculator

http://www.usacoinbook.com/

10.28.10 Will the US Treasury Take the

Nickel out of Circulation?

Or will they debase the coin, to plastic or zinc?

Nickel currently has about 7.5 cents of metal.

We've been selling rolls of 1940's and 1950's nickels for a

premium!

Even then, we are selling less than the intrinsic value...

10.28.10 Will the Fed Give up on Paper Printing

and will the US accept a plastic dollar bill?

Many countries use polymer notes:

http://www.pmgnotes.com/news/viewarticle.aspx?NewsletterNewsArticleID=933

10.28.10 Federal Reserve Delays Release

of Redesigned $100 Note

they can't even get the scrip right!

---

A problem with the paper creasing during printing has delayed the release date

of the redesigned note.

On October 1, the Federal Reserve Board announced a delay in the issue date of

the redesigned $100 note. This new design incorporates cutting-edge,

anti-counterfeiting technologies and the Federal Reserve imposes strict quality

controls to ensure that users of US currency around the world receive the

highest quality notes.

The Bureau of Engraving and Printing manufactures Federal Reserve notes and has

identified a problem with sporadic creasing of the paper during printing of the

new $100 note, which was not apparent during extensive pre-production testing.

As a consequence, the Federal Reserve will not have sufficient inventories to

begin distributing the new $100 notes as planned.

The Bureau of Engraving and Printing is working to resolve this problem, and the

Federal Reserve Board will announce a new issue date for the redesigned $100

note as soon as possible. The originally scheduled issue date was February 10,

2011.

Source: Bureau of Engraving and Printing

10.26.10 CA State EPA Perpetrates Fraud,

once again

The California Air Resources Board (CARB) has belatedly disclosed that its

scientists have overestimated state diesel engine emissions by 340%. CARB is the

powerful state agency charged with researching and regulating air quality

standards. These diesel pollution estimates were the basis for costly 2007

regulations.....

.....Worse, last year members of the CARB learned that the author of critical

studies on diesel engine pollution, Hien Tran, had falsified his academic

credentials. Tran admitted his deception, and accepted a CARB demotion. However,

Tran’s analyses remained the basis for the aforementioned pollution regulations

imposed upon operators of trucks, buses and other diesel-powered machinery" ....

http://www.examiner.com/ecopolitics-in-los-angeles/calif-climategate-part-ii-air-board-s-340-pollution-error

10.21.01 Tweets Precognize Stock Market

Action?!?

The general mood among Twitter users can predict the rise and

fall of the stock market almost a week in advance, a new study has found.

A computer scientist in the US has discovered that the correlation between the

Dow Jones and the collective public mood was almost 90 per cent accurate.

The link raises the startling possibility that stockbrokers may one day be able

to make bets on the stock market based purely on how people are feeling on

Twitter and blogs

Read more:

http://www.dailymail.co.uk/sciencetech/article-1322133/How-monitoring-Twitter-users-feeling-predict-stock-market-days-advance.html#ixzz1303watsm

10.21.10

The English are taking copper out of the 5 and 10 pence coins

Will used nickel plated steel.

The British govt figures it will

save 10M lbs a year.

But, the net result will

actually be a loss to economic production since the changes to vending

machines, parking meters, etc will cost over 40million lbs.

10.21.10 Is

There a Difference Between 440 and 528 Tuning?

Someone stated:

“nearly all modern music is

recorded in A440 Hz, which was identified by the military in the 1930s

to cause mass hysteria and nervousness in humans...it soon became the

standard everyone uses to this day.”

To Which I replied:

No, music is recorded in a key,

not in Hz. Granted, many guitarists tune to A440 but that is only

b.c. tuning to center C C523.3 (Piano) is a major pain! Guitarists

just picked up from where violinist and other strings left off.

Today many folks tune to open D

or A flat, especially when they are going for mass hysteria! Lol.

In fact, 440 was only

standardized b.c. some Germans who invented the tuning fork were able to

standardize a typical production run at that Hz. The original

tuning fork was about 20 Hz below 440.

Pythagoras used 256Hz for the

basis of his intonal scale.

The note that really causes

human discomfort is The Brown Note, har!

Actually, the subsonic range

(infrasound) below 20Hz does cause human discomfort. There have

been numerous studies of infrasound effects on the human system (we are

an electromotive field ourselves). Germans studied the effects

going back to the 1920s.

Many researchers have concluded

that paranormal activity is actually caused by repeated infrasonic

waves, reported as a general uneasiness. More pointed, repeated exposure

to the 17-19 range can actually affect the peripheral vision, causing

the brain to ‘see’ slight objects in the far fields of vision where none

actually exist.

That phenomena of a repeated

infrasonic wave causing reports of paranormal observations originally

occurred in factories where machinery would hum at a constant.

When the cause for the phenomena

was discovered, it was given a name: “Ghost in the Machine”

10.18.10

Found Out I Bought Counterfeit (altered) Coin

1932 Quarter with added D

Mintmark. I bought it in a collection, and was rather suspicious

of the mark. Glad I sent it in rather than try sell it! Been

pretty lucky, actually. First counterfeit coin I've purchased. (Well,

there may be another one or two I picked up on purpose for a specimen

piece). No chinese fakes, yet...

10.17.10

What deflation feels like, the story of Japan

http://www.nytimes.com/2010/10/17/world/asia/17japan.html

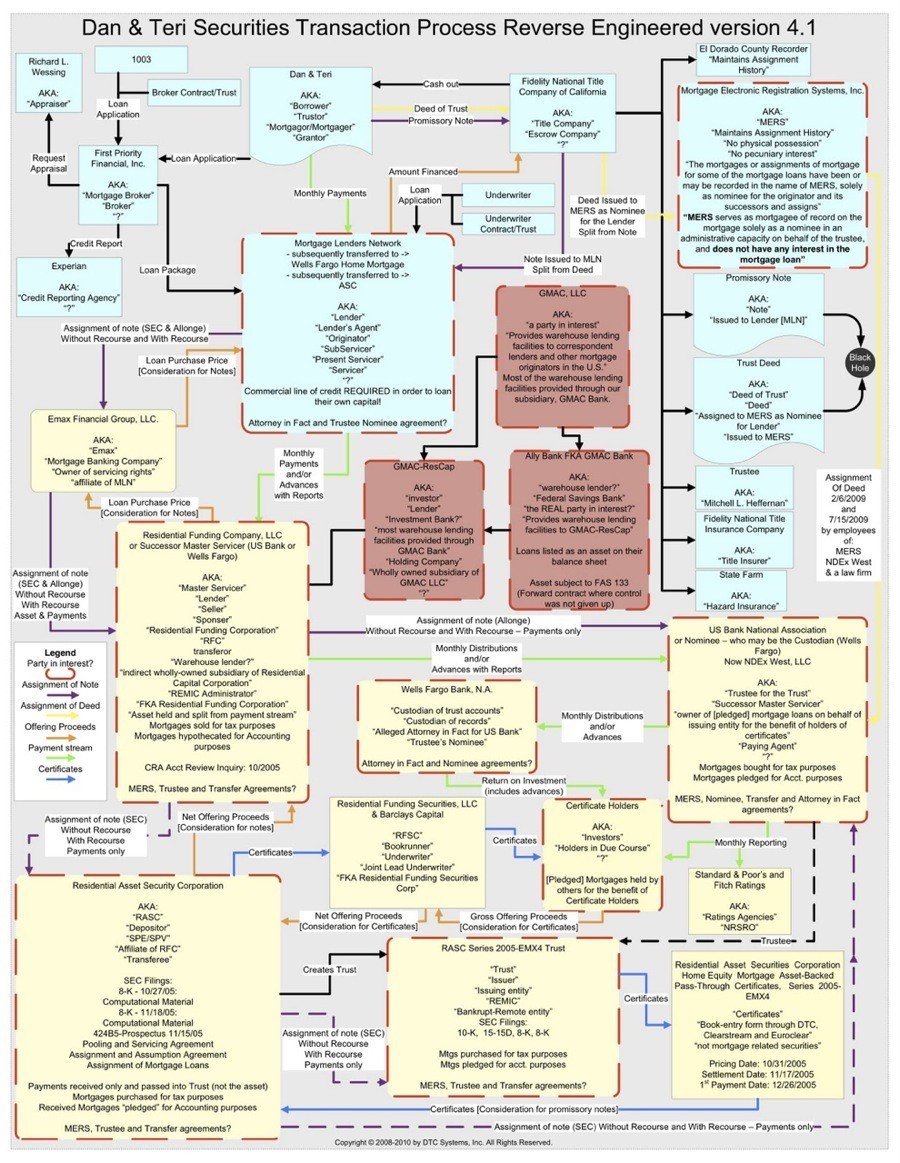

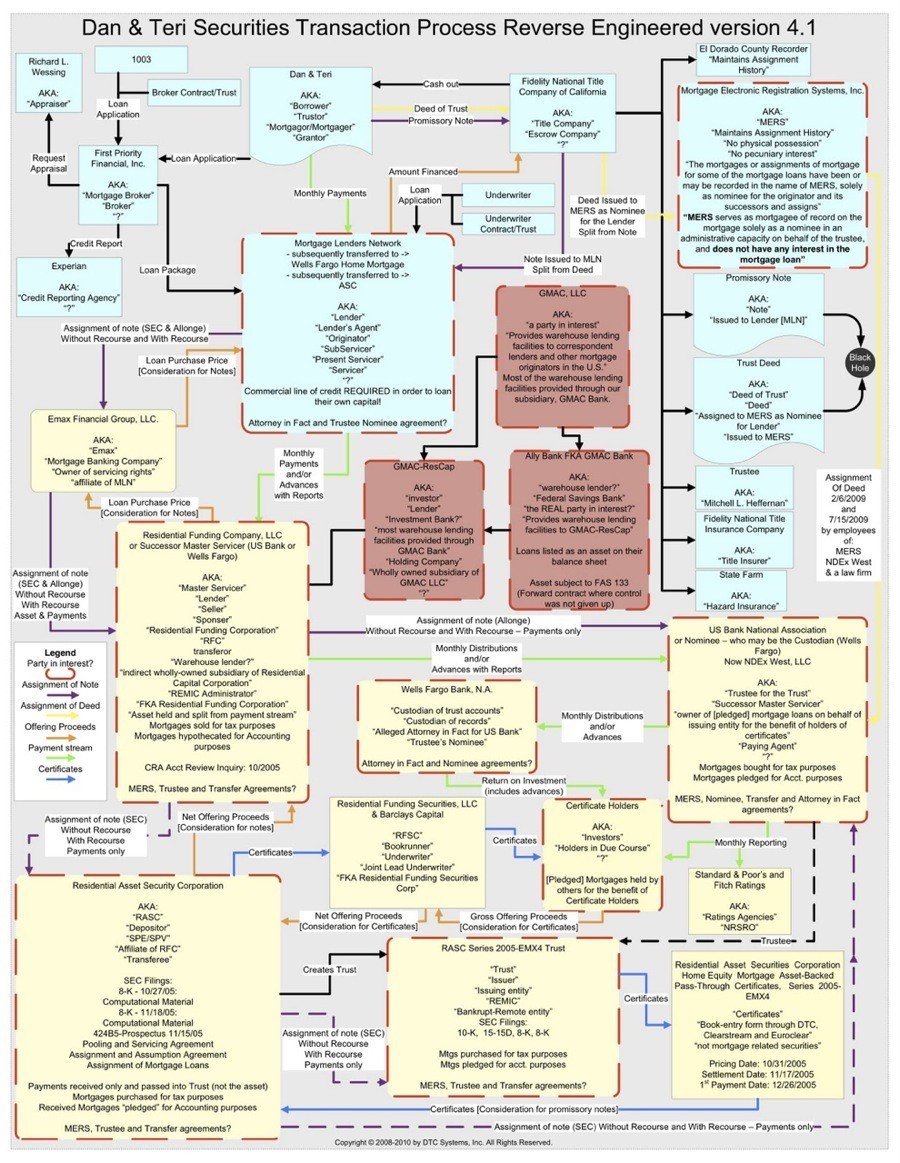

10.15.10 MERS Mess

The mortgage market is beginning to lock up. Heard

quite an interview on the radio today. Here is the site of the radio host:

http://www.realwealthshow.com/

Today's show should be up there soon as an archive. The

segment was with the second guest.

Last week Wells Fargo, Bank of America and a couple other

government-financed crime enterprises announced a moratorium on their

foreclosures. Note that a full 30% of the US single family housing stock

are foreclosed homes.

The lawyers smell blood and have initiated a feeding frenzy.

Why buy a house under this dark cloud?

Here is another take:

http://gonzalolira.blogspot.com/2010/10/second-leg-down-of-americas-death.html

Bob Chapman speaks to the subject beginning in minute 7.

Says the mess will take years to unravel.

http://www.youtube.com/watch?v=LDDl65Nb7sk

Big Mess

10.4.10 History Leaks Out

http://apnews.myway.com/article/20101001/D9IJ5O3G0.html

By LAURAN NEERGAARD

WASHINGTON (AP) - American scientists deliberately

infected prisoners and patients in a mental hospital in Guatemala with

syphilis 60 years ago, a recently unearthed experiment that prompted

U.S. officials to apologize Friday and declare outrage over "such

reprehensible research."

Just imagine the studies they are currently conducting on

you!

10.3.10 The Incumbent Love Fest Didn't

go so well

Look at the large patches of grass on either side of the

reflection pond.

AFL/Move On can import all the Section 8 housing freeloaders

they like, but the real working class stayed home.

MSNBC really embarrassed themselves this time!

http://www.msnbc.msn.com/id/39474438/ns/politics/

10.2.10

Asset Rich, Cash Poor = Production Land

The first case I heard this

term, and still believe it really applies best, is in regards to

farm/ranch land. Sometimes these large parcels of land have been held in

the family for generations and, as towns and cities grew up around the

parcels, the land has grown greatly in value. As a result, the

taxes on the land have also gone up.

However, the property does not

cashflow any more than it ever has. Hence, the underlying asset is

worth large $$, but the land is illiquid. Furthermore the sellers may be

very reluctant to sell the family parcel that has been held in one name

for 150 years; something akin to selling the birthright.

We know dairy farmers in

California and Ranchers in California/Nevada who are in a very tough

spot right now. Milk and beef have not experienced the same boom

that many other hard commodities have experienced in the past 10 years.

This fact is compounded by price fixing by the government. (In

California, Department of Food and Agriculture sets the price of milk).

More regulations, especially the

Concentrated Animal Feeding Operations section of the Clean Water Act

have really squeezed dairy operations.

Of course, the mom and pop

farmers also have to compete against an increasingly consolidated

corporate farm. Mom and pop don’t have the array of lawyers that

Monsanto, Con Agra and Archers Daniel Midland have. SO, the small

family unit has become squeezed out of markets. If you are forced

to use GMO seed, and the market for such if falling, you lose market

share. This compounds the problem of increasing price of supplies

(especially fuel and seed).

Rather than sale the land

outright, some of the mom and pop family farmers have put their land

into conservancy land trusts. Depending upon how the trust is set

up (through either the Williamson Act or Farmland Conservancy Program),

this trust either freezes the tax rate or may even pay a large one-time

cash payment in return for keeping the land farmed ‘in perpetuity’. In

essence the state puts a conservancy lien (‘easement’) on the property.

Nevada faces different

challenges to land value and illiquidity. Some of these factors

have been quite recent due to major land deflation across the state (and

a very challenging water rights environment).

Naturally, the political

machinations have set up some very nice means to profit from the

scenario via special tax districting...

10.2.10

Estate Sale Today

The guy selling the stuff, after

I asked about the coins, started asking me about gold. He had just

started researching the fed reserve, read Jekyll Island, etc.

He asked if I thought gold would

still go up.

I asked, in turn:

Have you bought any yet: “no”

Then gold will still go up.

I asked: Do you trust the

banksters;

“no”

Then gold will still go up.

I asked: Do you trust your

politicians?

“no”

Then gold will still go up.

He volunteered he was

buying/selling tube transistors, communications equipment.

I thought that was great,

especially considering my belief the next hot war theatre will involve

use of EMP weapons and I brought up Tesla.

Then the other guy in the room

started mentioning some of Tesla patents….

Folks ARE waking up.

And, California decriminalized

marijuana yesterday – definitely a chink in the private prison movement.

They haven’t even been able to criminalize being underwater in your

mortgage yet, so the prison trade took a big hit.

Look for bad news, that’s what

you’ll find.

Actually talk to folks, you

might be surprised…

10.1.10

Beginning of the Fourth Quarter, 2010

Things should get interesting!

Market Health

Getting harder to unload larger

coin/bauble collections, whilst demand for bullion coins is still quite

high.

The demand for better

mining/railroad scrip; obsolete and confederacy notes, etc continues to

strengthen.

9.26.10 Why forced diversity never

worked:

http://alphadesigner.com/project-mapping-stereotypes.html

9.26.10 A Decent Read

http://www.thecactusland.com/

9.26.10 Do believe that PCGS will

eventually need to change their slabs,

ala NGC,

to allow for visibility of the edge.

9.24.10

Johnny Cash: Hurt

Song written by Trent Reznor,

recorded by Johnny just a while before he passed on. Song written about

a junkie, sung by a recovered one.

The scenes with the memorabilia

were filmed at the John Cash museum, started by his mother, which had

been defunct for 12 years.

At the scene with the banquet

table, the producer said - John, this is our last scene go ahead and

throw all the food off the table or whatever you wan't to do to add some

drama.

John was at the banquet table

alone. He poured out a glass of wine all over the table. He was

alone b.c. of the loneliness he created from the booze and drug

addiction, and from all those who passed on before him.

http://www.youtube.com/watch?v=o22eIJDtKho

9.24.10 market technicians association

http://www.mta.org/eweb/StartPage.aspx

any decent content?

they held their conference in San Francisco Sept 17th; same day as the SF Mint

Coin Show. I went on the 18th to the coin show. Traffic was not nearly as good

as the first show last spring, but much better than the show last fall.

9.24.10 Tour of the SF Mint well worth it.

The guy that gave the tour this time was an architect and

former Mint Museum employee. The mint stopped production at that facility

in the 1930s, but reopened a Museum and administrative functions in the 70s only

to shut down again in the 90s.

Learned that the mint foundation was re-engineered based on the October 1872

earthquake. Did not previously know that. The dolomite foundation is built upon

a bed of sand. The entire bed of sand is meant to float, like a surfboard,

during soil liquefaction. Had they actually tied the mint into the bedrock, the

foundation would have fractured and the facade and floors would have collapsed

in the 1906 SF quake. Instead, the mint only experience surface damage to the

facade from the FIRE, not the earthquake. The fire burned so hot (all the

buildings around the mint burned to the ground) that the water vapor in the

sandstone caused the sandstone facade to literally explode.

The mint superstructure was saved because the building

courtyard was built directly over an artesian spring, which was turned into a

well. Since the mint had backup power, they could pump the well and direct

the hose onto the sandstone to prevent even more of the facade from collapsing.

Since the mint made it through the earthquake and fire relatively undamaged, and

since the mint had its own water source, the building became a sanctuary and

then center of re-building government in the downtown SF financial district.

9.21.10 Fall Equinox: Beautiful site in

the sky, a Full Moon flanked by Jupiter

9.20.10 All the Financial Bubbles: A

comparison

More outstanding work by Sharefin!

http://www.sharelynx.com/chartstemp/BubbleComparisons.php

9.20.10 Tom O'Brien Track Record on Gold

Price Action this year = Terrible

Not sure if he is trying to downplay gold so that his

listeners on TFNN simply give up and send in their precious metals to his 'Tiger

Club' which buys metal below melt value, or if he really is that poor of a chart

reader/fundamentalist.

Now, I have only been listening to him for about a year,

since our local financial station just picked up his 'show'; but in that time he

has called for gold to experience a large price correction multiple times now,

only to be wrong at every juncture as gold price makes new highs in dollar

terms. Hope his jewelry trade pays the bills, b.c. his gold trades sure

don't!

9.18.10 Commodity prices + wages +

transportation = prices for finished goods

Since the lows of 2008 the

prices for silver, copper, gold, wheat, corn, rice, soybeans, cattle,

hogs, sugar, cotton, coffee, cocoa have all surged.

Cotton prices alone rocketed up

28% in just the past 8 weeks. Cotton is now at the highest price level

in 15 years. This will guarantee higher clothing prices down the line.

When combined with major wage inflation in China, US stores will be

forced to pay higher wholesale amounts, since other countries

(Indonesia, Vietnam, etc) will be able to increase their prices.

American shoppers should see unprecedented rise in clothing prices

within the next 6-9 months.

9.18.10 Plenty of Ways to 'make a buck'

on Government Graft

Sure, there will be plenty of

ways to make a buck on this one.

Start a ‘minority/owned’ front

company to land a government contract via typical channels of nepotism

and fraud. Take the $500,000k authorized in the RFP and deliver

38% to the people who are supposedly protected by the bureau. The other

62% is agency overhead (vehicles, office space, promotions, ‘health

care’, workers comp fraud, lawsuit settlement, overages, standard theft)

and ‘profit for services rendered by contractor’.

One issue I SELDOM see discussed

regarding all the ‘OPPORTUNITIES’ for making a buck on “Health Care

Reform”, ‘Consumer Financial Protection’, Clash for Clunkers, ‘Police

Actions’ or any of the other bureaucratic boondoggles is business

ethics; especially in relation to standard economic theory/underpinnings

of micro capitalism.

In essence, some folks see no

ethical difference between profit made via inventing a cure for disease

vs making a buck from police action (illegal war) profiteering.

My parents and grandparents (and

probably yours) made an honest living on a spread between the value

added by their labor/education and what the product realized on an open

market, triple net.

That work ethic is not lost in

all of us, but has obviously become a point of ridicule for a large

swath of the public, many of them reliant on taxpayer largesse or

defaulting on their promissory notes

Secondly, the point initially

made, albeit briefly, is that new fees/taxes/licenses do NOT accrue to

GDP. These are a drag on the economy, not a lifeboat.

The bureaucracy DOES add costs

to the business process. A case study on this exposition relies more

accurately on national economic development studies over the past

centuries rather than a string of posts in an ephemeral thread.

Denying such via reliance on an

argument that others making the point are ‘whiners’ or ‘complainers’

does little more than immediately bring down the economic/business

debate down to the lowest denominator of ad hominem sophistry.

Submitted most respectfully, all

$/Dollar are not made equal.

9.17.10 Kinross merges with (acquires)

Red Back Mining

According to the supplemental Kinross (KGC) circular mailed

out this week.

The arrangement provides Kinross

with exactly the type of early production property they have shepherded well in

the past several years. Also provides important exposure to the

bourgeoning west africa lodes. Looks good to me

Mauritania and Ghana Proven and Probable (PP) reserves are

currently at 5.9M oz AU.

5.9

PP x $1,200/oz AU (9,17.2010)= $7,080

$7,080M of PP/ 256 M shares outstanding (7.1 M float)

=

27.6$/share per PP AU

Kinross (KGC) paid $21.3/share USD (warrant price)

21.3/27.6 = 77%

.77

x $1,278 oz = $986 per oz paid per PP.

BUT,

the Feasibility Study for Tasiast wont even be completed until 2011.

Expect quite a bit of inferred reserves to roll into the PP column then…

So, the $950 quote for deep storage is about right for Proven

and Probable, but WAY high for ALL resources (including inferred).

Large reserves (5M+)just waiting around to be plucked don't

appear quite lying around waiting for a pluckee anymore.

That, and cost of mining in Nevada and Austrakua don't exactly look to be going

down any time soon...

9.17.10

Made up DC gun

death rates

Non-factual hyperbole which actually works against gun rights defense.

C’mon, you really believe DC has over 3,000 gun deaths every year?!?

http://dc.about.com/b/2008/03/12/firearm-death-rates-in-washington-dc.htm

Kinda reminds me of the ‘tea partiers’ who generally seem motivated to

equating public dissatisfaction with government to racism/extremism.

Thinly veiled provocateurism, but that’s what sells at Walmart these

daze…

9.17.10

Great Coin Show Sept 17&18, San Francisco Mint

This is an awesome place for a

coin show. Nice group of dealers, too.

Worth going, for sure.

Here is a coupon:

http://griffincoin.com/page5.html

9.17.10 September 17, Interesting Day.

Founding of the Presidio of San

Francisco, the oldest military base on the western coast of North

America. The Presidio was an active base under three flags: Spanish,

Mexican, US. The base closed in 1995 when the local politicians

decided they would rather have the place serve as a real estate slush

fund to support their re-elections and pet projects.

Constitution Day, US

Battle of Antietam (US Civil

War), still the bloodiest day, in terms of loss of American life.

9.16.10

Silver Broke through price of $20.67

There wasn't any real technical

resistance there, but there did exist one interesting fundamental point:

100 years ago the price of GOLD

was fixed at $20.67 by the US. We actually had the power and

reserves to keep the price fixed.

Oh, how the mighty have

fallen...

9.9.10 Buy PGE?

PGE made a high just the day before, so technically it will

probably break down from here. I would wait a few days. BP went down for

weeks after the oil spill b.c. liability wasn't fully known. Same with PGE.

There are media reports that folks smelled gas for a few days. Wait a few days

to see the action, i think it will go lower BUT provide a very nice buying

opportunity. PGE controls so many crooked politicians, and is such a great

monopoly, they can't lose long-term.

9.7.10 Bring the Kids to Burning Man?

This year at BM one of my quests

was determining if I should bring my children, currently 2 and 4.

Since 1984 I have been visiting

the Black Rock/Smoke Creek deserts and understand the logistical and

medical challenges. Those are generally ameliorated by having

Black Rock City infrastructure present (multiple paramedics, ambulances,

and air-evac available; medical tent, and numerous trained and staffed

professionals available.) Currently there are epi-pens. Ventilators.

Sterilized equipment, oxygen, saline lines, and various other medical

support that are generally not available when you go camping anywhere

else during the year.

The time it takes to get to a

hospital emergency room from BRC is actually less than the time it takes

to get there from many other smaller Nevada towns (Tonopah, Ely,

Yerington, etc).

I interviewed perhaps 100 people

this year regarding the topic, about 70 people with children and 30

people w/o children. Found that the folks w/o children were split

about 50/50 whether or not it was a good idea to bring a child. My

sense was that split generally mirrored their ideas on having a child AT

ALL, BM or elsewhere.

The parents, to a tee, stated

their kids loved BM. I generally saw the children really enjoying

themselves EXCEPT when the weather turned sour (extreme calm heat or

extreme dust storm).

The ideas on what ages were

best/worst are varied. Many people did not feel an infant was able

to properly adjust to the dust and was prone to dehydration (ore

verbalize their needs). Other folks felt strongly that

tweens/teenagers could have comprehension problems regarding what they

saw.

Kidsville grew into a VERY

organized and functioning camp. Their first year, 2001, was actually the

last time I was at BM. Kidsville organized itself to meet the

demands of the playa and the event. The number of semi-structured events

and activities proved surprising and comforting. When I entered

the camp (there was really only one major entrance) I immediately saw

folks looking at me (a single male) much like a neighborhood watch

program.

Initially my perception was that

the parents with children must have deliberated for quite some time on

the pros vs cons of kiddies at BM. Overall, I found that was not

the case. The parents intuitively knew their children could not

typically follow voice command or would have problems with the weather

were staying with grandparents/babysitters (stayed at home). Most

other parents were just of the mindset that the children were part of

the family unit, they went where the parents went, good times or bad,

penthouses or camping camping. The parents I interviewed provided

really illuminating answers; they had thought through both the

philosophy and the logistics.

Here was the consensus on the

best methods for bringing children:

-

Wait until they can speak

(tell you their physical needs). Personally, I will wait until

the kids are 4 and 6.

-

Bring a trailer/RV and camp

in Kidsville. You can shelter from the sun/storm in an RV in

ways you cannot in a tent or other vehicle. In our RV this year we

had AC/Power/private sink-toilet-shower, clean facilities,

refrigerator, etc.

-

Go to BM with another

couple you already know and trust so that you can watch each other

kids for 2-3 hours while parents go for the NIGHT party.

-

The days are very enjoyable

for children if THEY DON’T HAVE TO WALK. The two best methods

for child transportation are: A) A shaded/vented bicycle trailer

where the kids sit that are powered by mommy/daddy pedaling. B) A

mutant art cart (four seater golf cart tricked out). This

allows you to strap the kids in the back seats and take the children

EXACTLY to the art pieces you want them to see while speeding past

the more ‘adult’ camps/domes. Also allows you to get back to

the RV at the first sign of developing dust storm.

In sum, most respondents were

supportive of children and with the mitigation/management techniques

presented above.

The BM experience, like the rest

of life, is different with children. Seeing the event and art through

their eyes presents unique rewards and challenges.

I am comfortable bringing my

children when the youngest is 4 years old.

See you there…

8.30.10 Why the Banking Act of 2010 is

Only designed to spark further Class Warfare

http://www.ft.com/cms/s/0/93ff41de-b457-11df-8208-00144feabdc0.html

8.29.10 Thanks

to you, our Customers!

Our

sales have done really well this summer, traditionally the slow time for

precious metals and coins.

In

part I know we are benefitting from larger trends: the precious metals

have generally out performed every other market for a solid decade.

Was nice to be right about that one, eh?

8.24.10

How to Devalue a Currency

Step One: Take the specie backing away.

Status: Completed in 1913/1964/1971

How Fallen Empires Devalue their

Currency, leading to collapse

"Silver coins were

a basic medium of exchange during the empire, and one of the major Roman

coins, a denarius (plural, denarii), equaled four of the smaller silver

coins called sesterces. During the reign of Augustus (circa 30 B.C.), a

silver denarius weighed 5.7 gm (.20 oz) and was 99 percent pure. By AD

193 it had dropped to 4.3 gm (.15 oz) and was only 70 percent pure. The

deficit spending of later emperors nearly halved the silver value of the

coinage.”

The

soldier-emperors who followed the Severan rulers continued to treat the

military generously, but as tax collections fell and silver mines were

exhausted, imperial funds disappeared. The treasury melted down

available coins and issued new money that had less real value. By 270

the silver content of the coinage was only 1 percent. This devaluation

of the currency soon had a terrible effect on Rome. As money became

worthless, much of the empire was reduced to a barter economy. The state

collected food, animals, and other supplies instead of tax money. "

http://www.crystalinks.com/romanempire.html

The

marketplace last devalued paper relative to metal in 1964 and 1965.

According to Burton Hobson in International

Guide to Coin Colleting, [First Edition. New American Library.

New York. 1966]:

"..we

had a coin shortage so severe that commercial banks at one point were

forced to offer a few cents' premium for every dollar's worth of coins

turned in, so that payrolls could be met and change made to the penny."

Step Two: Remove Larger Denomination Currency so that all

Transactions Must go through a Central Clearing House (federal reserve

system).

Status: Check. Completed via removal of the $10,000 $5,000

$1,000 and $500 dollar bills, in 1934.

Step Three: Eliminate Coinage

Status: Almost complete.

Should

the penny be removed from commerce?

well,

A one

ounce gold American Eagle has a denomination of $50

whereas

the market value is roughly $1120.

Is this a

problem?

Um, yep.

But don't

take my word for it...

Let's see

what Charles Jenkinson had to say about the general subject in

A Treatise on Coins of the Realm:

"A

difficulty then existed, and continues to exist, which must necessarily

be removed, before any plan can be adopted for the improvement of the

silver I have already observed, that silver and gold, in reference to

each other, are estimated at Your Majesty's mint at a different value or

price, than these metals are generally sold for at market. As long as

this difference subsists, both of these metals will not be brought, in a

sufficient quantity to the mint to be coined: that mineral will only be

brought which is estimated at the lowest value with reference to the

other: and Coins of both metal cannot be sent into circulation at the

same time, without exposing the public to the traffic of one sort of

coin against the other; by which the traders in money would make a

considerable profit, to the great detriment of Your Majesty's subjects.

And

this mischievous practice, and the frauds committed in carrying it on,

are the more to be apprehended in this country, where the Mint is

free: - that is: where every one has the right to bring gold or silver

to the mine to be converted into coin; not at the charge of the person

who so brings it, but of the public: for,...the charge of coining Gold

and Silver has been born by the public; and, contrary to the practice of

most other countries, no seignorage has been taken.

To

prevent this evil, it is necessary to determine, whether there must be a

standard, or superior Coin, made of one metal only; and whether

the coins of other metals must not be made, and take their value, with

reference to this standard Coin, and become subservient to it; - and, in

such case, of what metal this standard Coin, to which the pre-eminence

and preference are to be given, should be made."

Now,

substitute copper for silver (or metal - such as it is, for paper notes)

and talk about removing the modern cent from circulation...

In the

1950's, Japan introduced aluminum coinage into circulation for the first

time in her history.

Source:

Coins through the Ages. Laurence Brown.

Bonanza Books. New York. 1961

Don't

take my word for it, Part II:

The

Silver Dollar Epitaph

Born -

1794

Died -

1935

Buried -

1964

- William L. Graham Jr.

The Silver Crisis. Hickory Press. Lake Forest.

Il. 1964. 134 pages. Softcover.

"At

the end of February, 1933, just before we went off the gold standard,

there were in the United States a little over 8 Billion Dollars of money

(aside from that held in the US Treasury). Of this sum about two-and a

third billion dollars consisted of gold coins and gold certificates."

-

Edwin W. Kemmerer.

Kemmerer on Money. John

Winston Company. Chicago. 1933. Hardcover. 197 pages.

With the following inscription:

-Dedicated to the Memory of

Grover Cleveland: A fearless and valiant champion of sound money.

No wonder

Cleveland is seldom mentioned in the top five presidential rankings...

"The

evil effects of such decline (silver and gold against available

commercial monetary expanse) were enormously increased by the

shortsighted, crafty manipulation of currency by the european rulers.

..and by the inability of the age to understand, or even to perceive,

the hidden working of two metals see-sawing against each other -acting

as levers against each cutting each others throats. The discovery of

America corrected the fall of prices and saved europe, but it left her

rulers as deadly ignorant as before of the workings of bi-metalism to

give a name to what they had not even perceived as a phenomenon, much

less system."

The

History of Currency: 1252-1896. W.A. Shaw.

Step Four: Establish a two-tier currency system, one for

international settlements and one for internal trade.

Status:

Partially completed via the Bank of International

Settlements. The next step will be to establish one currency for

trade and one currency for day to day transactions.

The

day to day currency (a newly introduced red-back) will immediately

plummet in value and continue to erode until, eventually, the public

will abandon it all together.

The

currency for international trade (the greenback) will be backed by

actual US assets. This has already occurred to some degree via locking

up western BLM-managed lands containing mineral ores for eventually

hand-off to the Chinese.

A better

solution, but politically unpalatable, is for the US to call a spade a

spade and devalue the US 'dollar' (the Federal Reserve Note) by one

significant digit. At one point a (large) cent could buy a loaf of

bread. A loaf of bread nowadays is $3. So, = knock off two digits from

the dollar, and that FRN would be worth what a post 1982 cent is worth

today - one cent. Although, you would still need 3.5 cents to buy

the loaf of bread, look at it this way, now the loaf comes with slices

so it is 'value added', part of the productivity daydream nightmare that

has allowed flawed logic to devalue the dollar some 97%.

At some

point the Red Note FRN will circulate outside the country at some

discount, or premium to, the domestically traded greenback. We may as

well position ourselves for this eventuality and influence its due

course to whatever degree possible.

Step Five: The greenback stops trading. Most citizens readily

accept the Iris scan and carbon credit allocation system. For

those that won’t (religious objection or those in rural environments)

the Government takes, instead of your useless scrip, actual material

such as ammunition, food, stored goods, etc.

The

way this is introduced is by first eliminating, or more likely, making

non-palatable, any non-government spending accounts.

For

example, Phil Grande played a great obama quote yesterday, to wit: “I

don’t have a problem with folks that have money in IRAs”. Well,

isn’t that benevolent of our dear leader. Of course, next quote

will have the modifier (..provided they are already fully invested in

the government IRA/MSA/HAS/MEDPLAN/ first”.)

nah, Could Never Happen Now/Here…

8.24.10 Today's Lousy Housing Numbers

Real Estate: Single Family Home

Started looking again for a SFH to buy/re-hab/rent.

last two properties I have penciled up and then called the listing agent already

had multiple qualified offers (*and they didn't want anohter offer!).

Neither were on the market more than 60 days, both had significant problems to

boot.

Real Estate: Commercial/Industrial

Helped out a local water district looking to rebuild a water

reservoir. Some of their quotes look like they are coming in AT cost, just

to stay afloat.

Not good...

Water operators becoming scarce. This year the State of

California dropped its standards on who can disinfect/treat water from a

Treatment License to a Distribution License. Much easier