12.31.08 2008: The nation

turned increasingly divided and intolerant

Fomented by the propaganda developers one-quarter

picks blue and one-quarter pick red and half refuse to play the reindeer

games.

Too bad some folks will close their mind to the

point they will only listen to a handful from amongst the chorus. Some

clam up and can only hear the lower vibrations whilst the higher notes

call and respond from a full orchestra - swirling around their clouded

vision. Such is the tragedy of our time.

I’ve learned from everyone I’ve met over the years

here. I surmise the wisdom each has imparted as we’ve passed he hat has

aided my endeavors and kept those cold chills blowing in the world from

dampening the hearth keeping my world warm.

Best wishes to all in 2009.

12.31.08 End Year Performances

$834.50 Price of Gold on 1.1.08

$880.80 Price of Gold 12.31.08

Dow was down 33.8% in the same period. The S&P

performed even worse.

Gold protected against both inflation and

deflation, just as it should.

12.29.08 Back from Christmas holiday

Breaking News: The 1994 edition of the booklet

Characteristics and Risks of Standardized Options

has been amended to reflect changes in the Options Clearing

Corporation's rules and those of certain options markets.

Source: Etrade

12.21.08 Time to Sell Your

Business?

12.20.08 New York Times covers their own, sinking together

12.19.08

The State of California Cannot sell bonds, any bonds.

The states’ credit rating is on the steep

and slippery slope. This week the Department of Finance and The

Legislative Analyst (E. Hill) report the state 44Billion in the hole

over a two year period.

Earlier the Sac Bee and Fresno B

(carrying the AP line) reported just infrastructure bonds were no longer

moving. However the Pooled Investment Board is no longer issuing ANY

state Bonds.

The complete inability for the press to

report anything regarding a factual account of the state’s or nations

financed, much less the investigative reporting of such, provides the

opaque and sickenly sweet icing on the empty calorie cake, rotting from

the inside out.

http://www.fresnobee.com/384/story/1083068.html

Note that the largest financial story of

the week has ZERO comments on the column, in one of the states largest

demographic areas - Fresno. Ho hum, maybe we can get

conversation started on which movies opening this weekend are worse

(worse than the headlines).

12.18.08 Someone else posted,

salient point:

I lifted the post entirely (no link available):

has'nt anyone learned

the lessons of 911 ? -

the RCA dome was imploded today. thousand pounds of dynamite and

thousands of man hours to set up.

when all they had to do was light a kerosene fireball outside and

set some small office furniture on fire inside.

poof ... building comes straight down

12.14.08

Why American’s Don’t Understand Finance

Part 334.2, section A SUB 2.33, Item 7

Paragraph 4:

Lack of Basic Math Skills.

Witness:

“The national price for unleaded gas has

dropped more than 125 percent from a year ago. Diesel prices have fallen

more than 80 percent.

From:

http://editorial.autos.msn.com/landingpagepickups.aspx?cp-documentid=763257&landing=pickups&topart=pickups&icid=711>1=22013

Wow, when the value of your one-dollar

coin goes down 100% it has no worth to anyone. When it goes down 125%,

you are willing to give me the dollar and an additional quarter for my

troubles?

12.14.08

The Private Corporation Federal Reserve states it feels no reason

To explain to congress or the lowly

citizenry – much less the taxpayer –

Where the billions/trillions of bailout

money went.

"Dec. 12

(Bloomberg) -- The Federal Reserve refused a request by Bloomberg News

to disclose the recipients of more than $2 trillion of emergency loans

from U.S. taxpayers and the assets the central bank is accepting as

collateral."

http://www.bloomberg.com/apps/news?pid=20601109&sid=apx7XNLnZZlc&refer=home

BTW, in case you were really curious –it

went directly to the Chinese and some politically connected bankers,

politicians and friends in Illinois and New York.

Next…

12.14.08

In Search of an Equities Market Bottom: Indicators

Only 2% of stocks on the NYSE are above

their 50 day EMA.

Apparently the lowest this indicator has

ever been.

As determined by Chuck Carlson and

reported by Gabriel Wisdom

Hi indicator is that equities are

oversold when 40% of stocks are trading below their 50Day EMA and stocks are overbought when 70% are trading above the 50Day

EMA.

12.10.08 28-day Treasury notes now trading at negative

interest rates

A very dire situation, first time that has happened since 1929.

12.10.08 Just ANOTHER 650 Scientists

Who are blowing the whistle on the global warming scam:

http://icecap.us/index.php/go/joes-blog

12.10.08 Poor California (really poor!)

Supposedly with a deficit of $11.2, $13.4, $30

Billion dollars. Whatever. The CAFR doesn't agree. What another bogus scam. All

out looting in broad daylight. For that matter, if the deficit actually existed,

why not follow the simple advice that I personally gave our last treasury

secretary:

1. Overturn proposition 13. That will free up Billions of dollars in short; a

sustainable tax base.

2. Allow the Glamis gold mine and others in Jackson, Rand Mountain and Red

Mountain to operate.

3. With the newly mined gold, mint the California gold specie again.

4. Issue a new 100-year State of California gold bond - actually backed 10% by

physical California gold-coin. The state would have the highest credit rating on

the planet of any government entity for the past 150 years.

Problem over.

12.10.08 Day Without a Gay

The Gay-out was a complete bust. Nobody noticed, much less cared. I guess it

worked if their goal was to make a laughing stock out of their cause.

Heck, if you don't need the work why not less someone who whines less take the

position?

12.10.08 Oh, poor Obama.

Not even in office yet and he is already caught up in a payola scandal. Only

fitting for the most corrupt individual to ever hold the office, and that's

saying something! How much do you think he paid (souled his sole) for the

last job (or the current one?). How will he pay for his wife's new exotic

metal ring now that he will no longer be getting a cut from the bribery offered

for his previous job?

More on the fools-gold plated affirmative action fraud parading as a statesman:

http://isteve.blogspot.com/2008/12/blagojevich-obama-link-runs-via-black.html

And poor 'ol little Jesse Jackson Jr. His daddy has to work overtime making an

ass of himself at the Republic Windows and Doors company so his son will have

the cashola for the payola. Will cost a little extra now, mr. prospective

crooked senator #5.

12.9.08 Blagojevich - the wretched soul - tried to take on

the wrong crown, the bankers.

At least he wasn't 'Kennedied'. But, he did try to cut off the spigot for

Bank of America. A big no-no. Now his life is ruined. Just yesterday he

stated the State of Illinois would no longer do business with Bank of America.

Ostensibly b.c. they would no longer to lend to the Republic Windows and Doors

company.

http://www.huffingtonpost...

Oh yeah, remember the other guy who tried to expose BAC for predatory lending

practices, in collusion with the Bushites.

His name was former SEC commissioner and NY Governor Elliott Spitzer!

As documented here:

http://www.washingtonpost...

Three weeks later he was ruined.

BAC is one of the 9 chosen ones. They are supported at YOUR expense.

Thanks to R. Paul for pointing this one out, he knows...

12.05.08 Haggard Wisdom, or

another Merle Pearle

From – Are the Good Times Really over -:

First line:

“I wish the dollar was still silver, it was backed,

and the country was still strong…”

Another gem, the last line of - America First -:

“Why don’t we liberate these united states, were

the ones who need it most. You think I’m blowing smoke, boys it ain’t no

joke, I make 20 trips a year coast to coast.”

Though – kinda hard to swallow anymore after

watching him back hillary. Just another show.

Quite a troubled thought, should the panic of 2008

lead to the roughest patch in US History.

The panic of 1907 gave us a nasty recession not

ended until the Federal Reserve formed to gain us entry into WWI.

The Panic of 1929 brought that depression which

really didn’t ameliorate until the mid 1940’s and didn’t end until the

1950s.

The Depression of the late 1850s proved especially

troubling. Hard to pin it on one or two event, more like an organic

decay. The rot ate so deep that the Civil War couldn’t flush it all away

and weren’t on decent footing until re-construction bore fruit in the

early 1870s.

Sobering thought – those 11, 22, or 14 year periods

of trouble in the past all contained a very vicious war, not at the end,

but in the middle or the depression.

12.5.08 Question for the

Canucks

Where does the 1.95 come from for every vote, and

where does it go?

12.4.08 On the Cost of Housing

Mine has been going down!

Over 12% this year! Got a nice fat check last year from the county and one

yesterday, as a point in fact, from my favorite bankrupt mortgage screwer -

Countrywide.

The lower tax rate will allow me to higher a rental agency to rent out and

manage this place when I leave. At least that's the plan.

Read someone else bagging on Vallejo and sent this

reply:

Are you aware of many cities amongst the oldest in

western North America with populations over 100k, a major university

(and two other college campuses), amusement park (which alone brings in

several hundred seasonal workers a year from foreign countries), and

major transit hub (recently stolen by the state) that don’t have any

‘bad dudes’?

Further, why would those employees leaving the

public service sector fear the budget re-negotiation unless they were

amongst the lowest performing members of the force? A public sector

RIFF historically clears out the worst performing actors. Not sure who,

exactly, are those individuals are that you indicate are quitting and

‘going’ elsewhere (presumably to other fire/police forces?). Local

fire/police are not hiring to any large degree. The majority of those

who left this year simply retired. Some of the more forward-thinking

ones left the state a couple years ago at the height of the housing

market to return home to childhood locales in the Midwest as both a

financial and family decision.

(Note: Vallejo-bashing actually supports my

personal interests as I am looking to buy additional property in the

city. The residential housing sector has the highest value-to-price

ratio compared to the 18 other counties I track in California and

Nevada.)

Interestingly enough, just this morning I received

the reimbursement check from my mortgage company. You see, the county

LOWERED our taxes by 55% since I purchased the single family residential

last October.

The city is actually making some very sound, if

difficult financial and political decisions. They, as a group, finally

let the cat out of the bag earlier this year when they admitted the city

could not meet financial obligations made by previous administrations.

The county, along with thousands of other cities, counties and states

across our bankrupt nation, simply haven’t grown the courage to admit

the situation and begin to work on solutions. That’s the reason Vallejo

receives the press- not that it’s different - only that it moved first.

I chime in only because your premise is otherwise

quite sound and the pejorative statements subtract from such. The

entire topic (mass scale bankruptcy) fascinates me to no end, has been

an area of inquiry of mine for years, and thus attracts my attention

here.

12.3.08 The Russian Purge of Lenin continues to fascinate

Though another one just as fascinating, and rarely mentioned, is the German

purge of the late 1840's. The burgeoning democratic revolution failed. Many of

the agitators left the country and headed for north and south America. The

Germans who settled in the states greatly advanced the nascent technological

revolution in the Ohio valley and growing western cities of Cincinnati and Saint

Louis and the mining, assaying and metallurgical efforts in California and

Nevada.

One notable difference in those purges of past totalitarian states and the

systemic authoritarianism of today: Back then the intellectuals were purged as

enemies of the great state leviathan. Today the intellectuals are tenured

tentacles of the propaganda state, espousing voluntary credit slavery to the

great beast.

12.3.08 Another great chart; quite concerning at that:

Gary Kaltbaum yesterday also pointed out the brewing

bubble

In the 30-yr long government bond.

T-bills now yielding at a 50 year low.

12.3.08 Gold behaving just as

it should in a deflation!

12.1.2008

12 days of Christmas cost

http://www.msnbc.msn.com/id/27984361

Gold drops over 11%

but the laying geese dive over 33%. Interesting how labor and

performing arts are just now rising in price, chasing the price push of

the commodities which peaked months ago. Still, a rise in paycheck of

3%, against a backdrop of doubles and triples in the cost of necessities

and a drop in assets provides for a Christmas dinner without much fat

this year for the working people.

As usual, MSNBC

butchers the article. Even their attempt at providing a link to the

story originator, PNC, was hijacked by a forex scammer. Typical

MSNBC fare/failure.

Too bad since PNC did

a good job with the story this year:

http://www.pncchristmaspriceindex.com/CPI/index.html

Though as a point in

fact, not as good as my 2006 write-up, which I won't top here either:

12.17.06 The cost of

living in 2006: The 22-year 12 Day's of Christmas Index hits an all time

high.

You've heard of the big

mac index, how much it costs to buy a meal at any mcdonalds in the world

serves as an indicator of the

value (purchasing power)

of both the host country currency and the value of the currency used to

purchase the meal. The 12

days of Christmas index

is an inflation gauge that measures labor and goods necessary to

purchase the 12 categories compared to

the year previous. Let's

examine:

http://www.pncchristmaspriceindex.com/ and

http://www.pncchristmaspriceindex.com/educators.htm

Of course, PNC bank - as

party-line establishment as they come toes the federal line and

determines that the 12-day index is only

up year-over-year of 3.1

percent, almost exactly the published fairy-tale number (fittingly)

promulgated by feds as the CPI.

Lets really work the

numbers:

A partridge in a pear

tree.

Making a double top high

this year? Perhaps the h5N1 virus has spooked players in the partridge

future markets?

Two Turtle Doves

Still at a twenty-two

year low and flat-lined? Why hasn't the cost of doves caught up with

partridges? Perhaps the whole dove

industry is selling soft

this year because peace doves are certainly not evidently in demand

anywhere on this planet given the

looming and active civil

wars afflicting a moderate percentage of the world's recognized

political countries. At any rate, soiled

doves seem to be

multiplying around my neighborhood now that wal-mart ain't hiring like

they once did.

Three French Hens

Given the inelasticity of

the market, obviously a product of France's rigged market system.

Four Calling Birds

Since these birds

actually talk, and give some indication of their state of mind and

general maintenance costs required to maintain,

they have proven a real

market - albeit one increasingly expensive and at 22-year highs.

Five Gold Rings

Yeah right, those haven't

appreciated any in value over the last year either (snicker). Gold is

only near multi-year highs and the

supposed cost of a ring

is near the five year low. Guess they keep factoring in more chinese

slave labor into the equation. Given

the shape of things on

this side of the globe they could add in the wages of US workers next

year for a further decrease...

Six Geese a Laying.

Well, if their product -

the golden egg isn't widely sought - then the bird flu might keep the

ganders' kin near all time highs.

Seven Swans a Swimming.

Not much movement in this market. Maybe the closing of the last US Pink

Flamingo producing

company in Florida this

year has something to do with it...

8 Maids a Milking.

Man o' Man, I see those

Merry Maid cars everywhere, so I don't get why this input has remained

so hard over the last few years!?!?!

And given the imputed

labor rate of $41.21 hr. to 'milk' I'm not sure what union the Milking

Maids have, but they're doing a fair

pinch better than the

merry maids I've seen.!

9 Ladies Dancing

I suppose, naturally,

that all depends on weather you go the lap-dance route where you think

you are getting off on the cheap by

using all those

one-dollar bills but it all adds up on an hourly basis or wether you go

the outcall-route using Craigslist and hire the

'ladies' on a contract

basis.

10 Lords a Leaping

Not sure who's looking

for that type of action, but they keep paying more every year!

11 Pipers Piping

More expensive every

year, guess nobody plays the flute anymore. And the casinos sure don't

hire much live music anymore, not

that the Blue Men Group

is really into flutes or anything.

12 Drummers drumming

Hey, Little Drummer Boy

is one of my favorite Christmas tunes for sure! Pah Rum pah rum pum in

another bottle of rum,

everybody's invited!!!

So much for the twelve

daze of merry haze, now, lets take a look at what it costs to just light

the Christmas tree:

Cost of power generally

up 10% year over year (this on top of a very large increase in 2005).

Cost of copper near all

time highs (needed to distribute power from production plant to your

home).

Cost of tree: flat

Cost of permit to chop

tree: Up again/still.

Cost of presents under

the tree. Up; see above.

Sure, if you don't plan

on celebrating you could save a few quid. Pass the rum...

12.1.08

The Equity Markets are Cratering Again

I like how the

headlines spout out how the markets were down huge today because of

reason x or y. However, the financial 'press' failed to note the

'coincidence' that Hilary was nominated Secretary of State today.

the markets tanked for that reason. Looked at how the equities performed

(tanked) the first two days after Obama was nominated. Same thing.

12.1.08

Letter to the Editor - New York Times Company; Dec 1, 2008

To the Editor:

Citigroup's troubles should come as no surprise. In 1998, when people

like Treasury Secretary Robert E. Rubin were busy persuading Congress to

eliminate New Deal firewalls between financial services sectors, many

advocates warned that this would create unaccountable and potentially

unstable financial institutions that were too big to fail.

News of taxpayers' huge bailout of Citigroup ("U.S. Approves Plan to

Help Citigroup Weather Losses," front page, Nov. 24) prompted us to dust

off a series of comment letters we submitted to federal regulators

starting a decade ago.

In a detailed comment opposing Citigroup's merger with Traveler's Group,

filed in July 1998, the Neighborhood Economic Development Advocacy

Project and others warned the Federal Reserve that "the size and

complexity of the proposed Citigroup would strain the banking industry

and the economy," and that failure of one affiliate "could lead to a

bailout using either deposit insurance or funds appropriated by

Congress."

Hundreds of billions of dollars in bailout funds later, we would hope

that President-elect Barack Obama's economic advisers -- many of whom

are Rubin proteges -- take the lessons of recent history to heart.

What's needed is a strong new regulatory system that serves the public

interest, not one that serves corporate greed.

Sarah Ludwig

Josh Zinner New York, Nov. 25, 2008

The writers are co-directors of the Neighborhood Economic Development

Advocacy Project.

Well, those folks pretty well nailed it. Thing is, future events are

very carefully orchestrated and telescoped well in advance. Not that

hard to determine future macro-events when one is really paying

attention.

12.1.08 Great article on a Mexican Mining Ghost Town -

Mineral de Pozos

http://www.sfgate.com/cgi-bin/article/comments/view?f=/c/a/2008/11/30/TRGQ146SJ1.DTL

The SF Gate typically publishes the most puerile content, such as it is. The

business and economic pieces are especially juvnile - designed by necessity for

a 3rd grade level understanding of economics - the base San Francisco

readership.

However, the rag has produced a number of good travel stories over the years.

These decent articles, of course, receive little to no mention via follow-up

comments. This particular article has four comment, sand only two further

develop the discussion.

. Naturally a 30 year story about roman polanski receives scores of comments and

those most illuminating articles define gays as the 'new negro' are good for

about a thousand comments; each one more banal and ridiculous than the one

preceding. This passes for public discourse today.

11.24.08 From Sorrow and

Pain Come Great Art.

Hemmingway developed many of his themes while

serving as an Italian medic-taxi driver in WWI.

Imagine the opus and masterpiece we shall all

witness 10-15 years from now arising from the next few years.

11.22.08 No way the Rest Of

the World will forgive US debt

Too much hatred of America, especially within our

country.

The people will demand that the very idea and

ideals of America fail and whither into disgrace. So, the latter.

There will be a few steps before we join the NOW of

course. In fact, we will be forced to BEG to enter the NOW. First we

will default on our T-bill, ditch the dollar, completely operate the NAU

with under the banner of the Amero (google hits now up over 1.5 million) or equivalent, etc. Only when the NAU

falters will the asian powers listen to our entreaties. Hope I’m wrong.

11.21.08 Future trouble in municipal water and waste water

operations.

Indeed, it will get really ugly. Those suburban

special irrigation districts we be rolled into the municipal systems by

fiat decree. The large city districts will be nationalized. The small

special districts will have their water rights stripped (nationalized)

and will be held out to dry. The waste districts will likely be left

unchanged but their waste produce will become a state commodity (reused

waste water is the potable drinking water for our cities over the next

century).

Further, the successful desalination projects will

nationalized for 'national security'.

At the American Water Works conference I attended

last month spent some time at the sessions where the industry briefed on

the status of desal plants/brine disposal. That and1 re-use of waste

water into drinking water were the big topics. FWIW.

11.19.08 Notice how GLD held

733 again today, closing just over 734?

The more times is holds there the stronger the

support becomes. Alternately, if the prices plunges through that

support, with heavy volume, the downside will be even further (maybe

lower than 710, the next minor support or even 650/670, the next major

support). When the price went below 733 a few trading days ago it was

on rather light volume, and thus it doesn’t trigger a sell. The move

must be more than 3% below the support on intraday basis to cancel the

support. Stops should be on a daily close basis.

Unfortunately, the general market weakened quite a

bit further today. The banking index is very technically bearish (see

here for more on that:

The real news today was not the posturing over the

big 3 automakers –they’re already bankrupt. Rather, the new crux of the

matter is will CitiCorp bring down the federal reserve. Citi is one of

the nine banks the Fed must preserve at all costs – and they are in a

freefall. Their last big move to open retail deposit windows in

California was a huge failure. They are now suffering cash flow

problems. If the Fed does save C, there should be a very nice and

tradable rally in the BKK (banking index) and market in general.

11.19.08 Selling Prized

Possessions

Went to the local B&M coin dealer.

He was in the paper today:

http://www.timesheraldonline.com/ci_11020757?source=most_viewed

People are now selling their gold/coins/jewelry

just for gas money. He hasn’t seen it this bad since he bought the shop

in 1987.

Buying has dried up. He was disappointed with how

little I bought off him today. Hey, I just went to the Santa Clara show

four days ago – give a guy a break!

Told him I’ve been putting more money into ammo,

plumbing supplies, water treatment gear, provisions, etc. He thought it

was a good idea, unfortunately.

Told him I just hoped I was wrong. I always wish

I was wrong more often.

And maybe I am. The house behind me had been for

sale. Not too long really, 3 or 4 months. The new neighbor bought it

after getting in a bidding war with someone else. He is immediately

dumping money into the place, fixing it up. The sales in my town are

going up. The average price is still declining b.c. the homes in the

hood are really sinking. However, home prices in the better

neighborhoods seem to have leveled off.

Folks use to make fun of my city b.c. it declared

intention of bankruptcy. I replied: “Your town (county/state/fed) are

bankrupt too but you haven’t yet figure it out/admitted it yet – whereas

we have. Just a little ahead of the curve –steep as it is.

Now the neighbors feel the curve:

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/11/19/MNHA143FHK.DTL

indeed they ARE deliberately destroying

The country. i've been saying so for years. most

people used to just roll their eyes. not so much anymore.

Weight of evidence? Arose from a slumber of denial?

Do you think the motive has just recently become deliberate destruction

where before it may have been gross incompetence rather than organic

malfeasance?

"A global economy requires

a global currency."--Paul Volcker

http://www.singleglobalcurrency.org/

11.18.08 Current Democrat

Level of Discourse

http://www.littledemocrats.net/Obama.html

11.16.08 Someone asked what I thought of this article,

http://www.moneyandmarkets.com/the-g-20s-secret-debt-solution-27996

So I told 'em:

Yes I already read this article and I've read

Larry's stuff before.

I do not think gold will go to tens of thousands of

dollars an ounce, that’s just something used to sell newsletters. Gold

will protect purchasing power when the dollar collapses, but it won't

buy 15-20 times as much goods as it currently buys when the currency

collapses.

Instead I see this as the most likely scenario:

The US politicians are well on their path of

destroying the nation through debasement of its currency and destruction

of our industry. Some more of their plan is simply being fleshed out

this weekend.

Very likely excerpts:

The US will default on the T-Bill in the next 36

months

The dollar will collapse

US politicians declare it necessary to destroy the country in order to

save it, force North American Union.

- The dollar will be destroyed to save it.

- The Amero, or similar, will trade as the NAU

currency.

- The Amero will have some 'link' to the price of

gold. The NAU will fix the price of gold to somewhere between 1,000

-1,500 per oz.

- GLD, comex, and monex will all default on the

gold contracts.

- Actual gold will trade on the black market for a

perhaps 100% premium above this price. (This scenario is already being

rolled out. The official price of gold is 720 and silver at 10. The

reality is its extremely difficult to find gold bars/bullion in quantity

below 775 and silver rounds below 12.

- Although gold will not be confiscated, it will be

illegal to trade gold for its true value. Those that trade it on the

black market will be prosecuted for terrorists acts.

- US presidential order will cease most gold and

silver mining in this country as ‘barbaric’, unnecessary and

‘unsustainable’. Government will seize the mines and nationalize the

industry, just as with the banking industry, the financial industry, the

credit industry, and soon the auto industry.

- As the NAU slips deeper into recession, the amero

will give way to electronic currency completely in order to starve the

‘terrorists’ (those that refuse the beast) of cash and food to survive.

Folks will clamor for the implantable RFID chip that allows them to

stand in line for government bread and cheese.

- Most americans will continue to vote demopuclican

and support –nay embrace – absolute criminals as they implement the

worst and most vicious police state ever to grace the planet. We are

well on our way.

Here’s a good summary of the folks currently

laundering your tax money to their friends in the banking industry:

http://thetradingdoctor.com/updatesandalerts_nonsubs/11-12-08_TheWorldIsComingToAnEnd.html

By the way, I went yesterday to the Santa Clara

coins show, one of the largest on the west coast. Although fewer and

fewer people have available money, they are still buying gold and silver

bullion when they can. Coin prices are fairly stable, though declining

for most series, having peaked in 2006.

All paper gold is a scam, it has always collapsed.

I have hundreds of documents showing just that. Only physical silver

and gold will survive. That is why the banking and credit industries,

supported by US government policy, has attacked the gold price ever

since the US began in Ernest to devalue the US Dollar.

As usual, hope I am wrong. Regrettably I haven’t

been wrong enough over the last eight years, as all documented here:

However, there are actually a number of people

waking up – there may be enough in the resistance movement to change the

NWO plans that the G20 are currently hatching up this weekend in Wash.

DC. Amazing how many people thought I was full of bunk since I

abandoned mainstream political economics in 1987 now start to see the

issues for themselves. Too bad it took the collapse of the US economic

infrastructure for it to sink in for too many individuals. The majority

are blind, but irrelevant anyway.

FWIW.

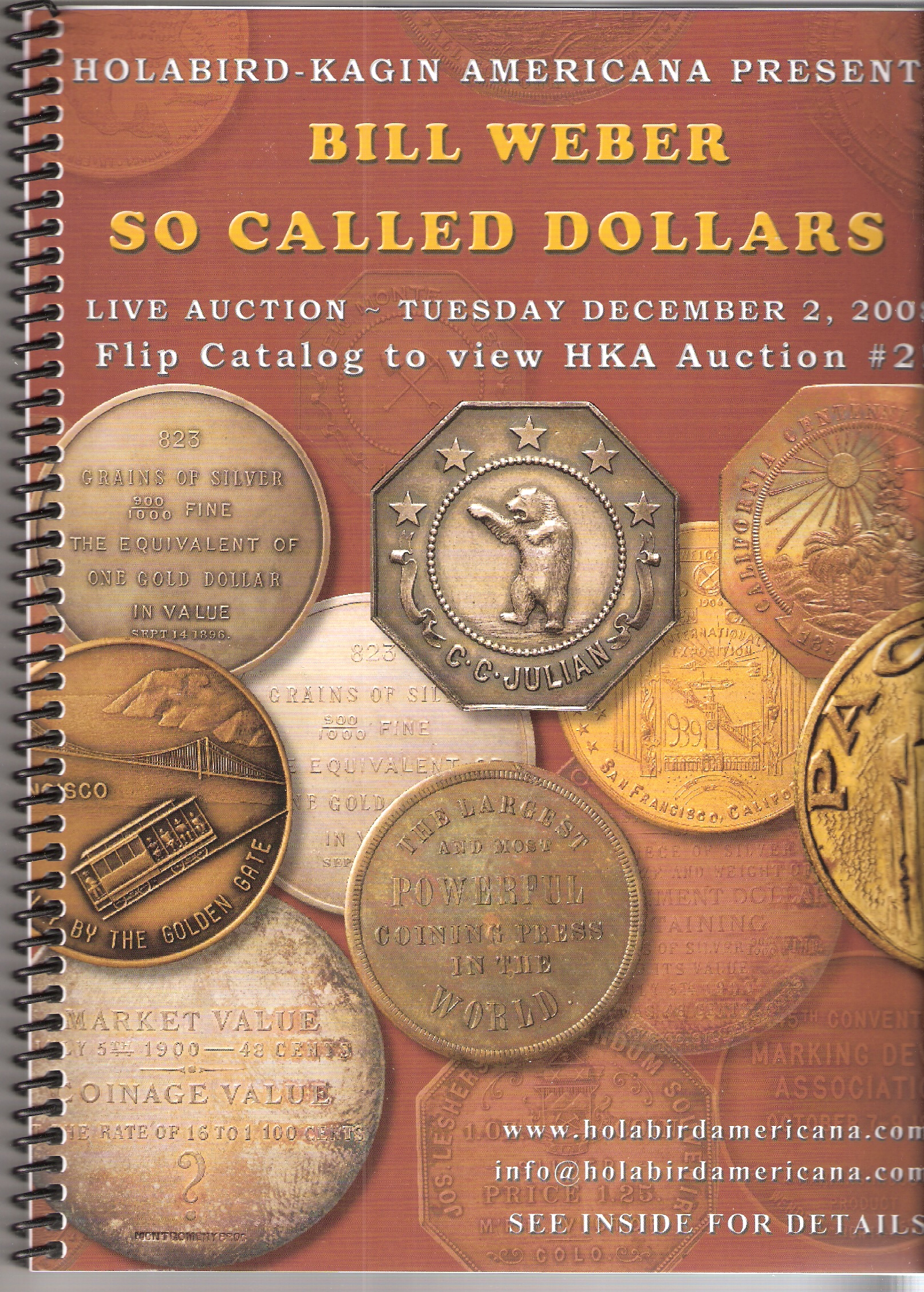

11.16.08 Santa Clara Show Report

Invested about 5 hours at the show yesterday,

Saturday, between 12:30 and 5:30. Show attendance seemed lower than

previous years, no doubt due to both economic realties and the gorgeous

weather outside. You couldn’t design a better November day.

I spent some quality time with 6 or 7 dealers.

Most were doing an ok show, one a good show, and one thought they might

lose money for the first time ever at this show.

Much of the chatter I overheard regarded

(decreased) expectations for the upcoming Baltimore show; state of the

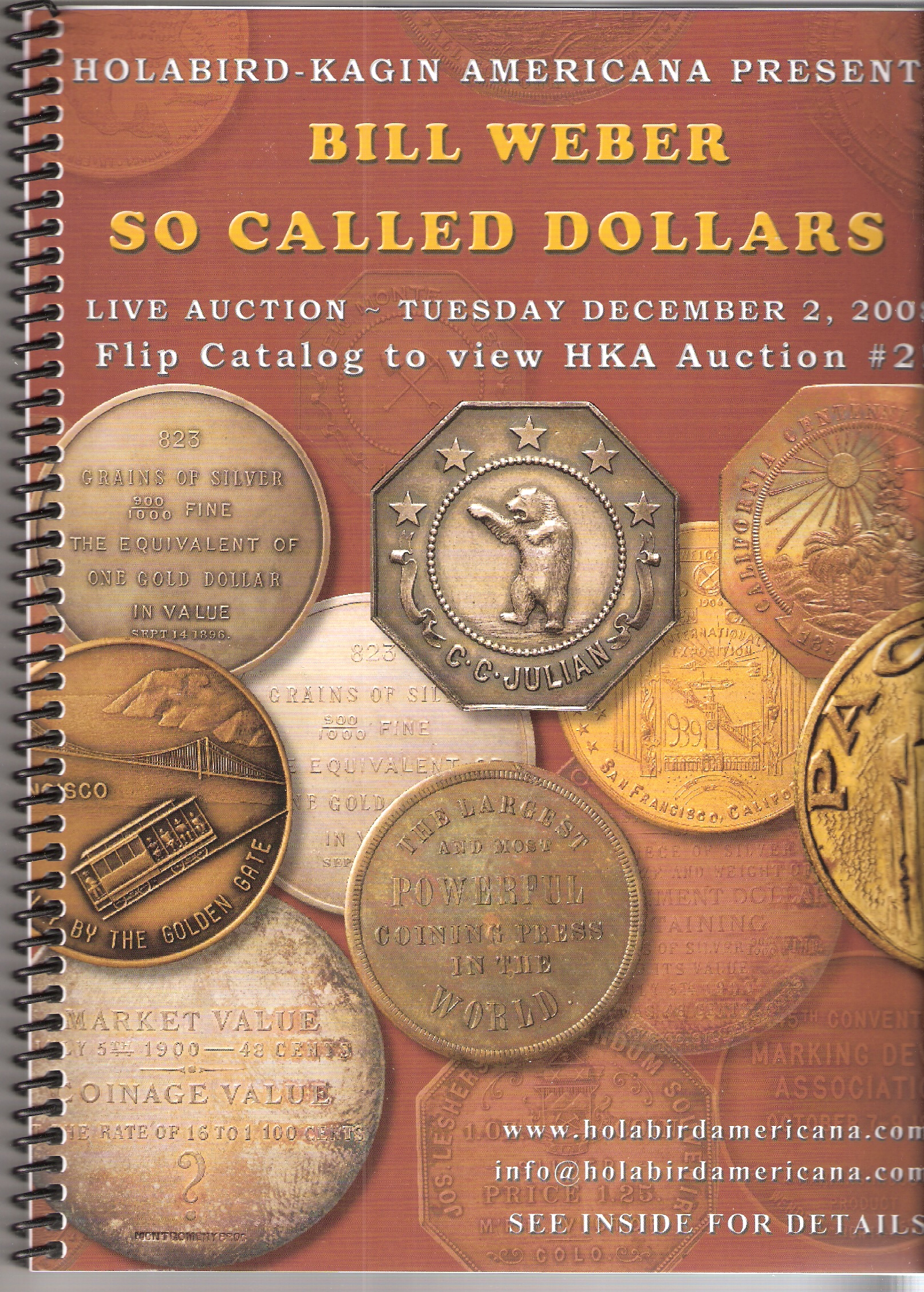

overall market more so than the coin market; and the Bill Weber

collection of So Called Dollars.

Weber Collection:

Looks like some mighty fine items from this

collection shall be auctioned off December 2nd in Reno.

Here’s the pic of the auction catalog for the

collection:

The fascination with the oddball So Called Dollars,

slugs, tokens and other exonumia resonates with me. Coinage displays

the financial history and mettle of a culture in 3-Dimesnions. So does

those OTHER avenues which display financial trade, advertisement and

documentation of socio-economic events and development: exonumia and

ephemera.

I have been trending away from coinage and more

toward the esoteric, banal and just plain earthy exonumia.

Something Old, Something New:

Personally, I sold off a couple gold 2.5 dollar

coins and bought more financial ephemera.

Here’s the obverse of the 1839 2.5 dollar coin I

sold – pictured here only as the reverse since I now see it only in the

rear view mirror (and realize what type of future I can realistically

expect in the coin photography arena – har!).

.jpg)

Over the past few years my focus shifted from coins

to tokens, financial paper and documents. These ephemeral financial

pieces document our shared economic heritage and financial history.

Namely, I focus on recreating, via economic

archaeology, that web of financial transactions which binds us

together. My specific targets are the various mining and resort towns

in Nv and Ca. For example, I search for a postal cancel of a town long

forgotten, a real picture photograph of the town (including the post

office if possible), a piece of scrip or a “good-for” token from the

local bar, and financial documents (leases, deeds, receipts, bills of

goods, checks, and financial corresponsive) which ties together all the

mercantile and financial history of the camp.

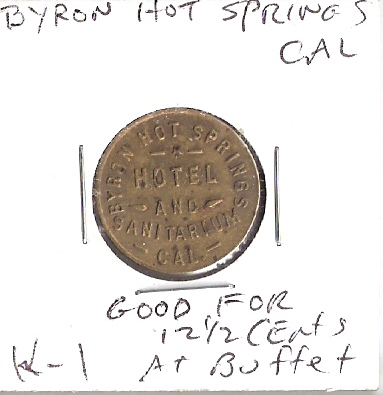

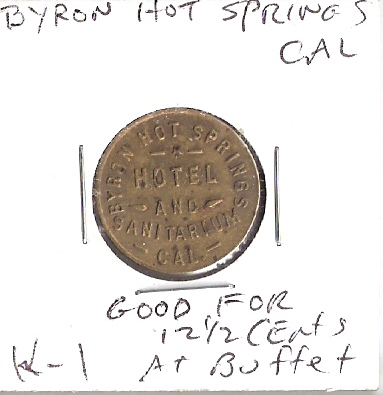

As just one example, Byron Hot Springs in Contra

Costa County was at one time THE place to play for the rich and elite of

the greater San Francisco Bay. Now just ruins, here is one presentation

of her previous gravitas and place in economic society:

This token is supposedly just one of two known.

(Hotel AND sanitarium, you have to love that

combination).

Of course there are other ways to preserve and

present the same topic, from a different side of the token. Here is but

one man’s artistic license at doing so:

http://www.flickr.com/photos/lostamerica/sets/72157600260134466/

Since the resort has been well photo documented,

and I have a sample of the traded exonumia, the last step in my

financial forensic triumvirate exercise is to find a piece of financial

ephemera remaining from the operation…perhaps a deed of title transfer.

There is always a remaining thread to track down,

perhaps NEXT show!

11.12.08 Does the Average Joe have Tangible Assets?

I go to garage sales every Saturday between May and October.

at most sales I ask: do you have any coins, stamps, old photographs, etc.

my experience is about 50% say no, and they are telling the truth.

about 25% say yes, but what they have is usually crap. however 1/3 of that group

will have between $100-1,000 on hand in bullion/coins.

The other 25% does have tangible goods put away. About 2/3rd of them do not want

to sell; they might take my card but rarely call. About 1/3 have something, but

either lie to me and say no, or simply smile with their eyes.

Very very few people WANT to sell their tangible assets, they'll hold on as long

as possible.

11.11.08 Another Inventory of the Little People's Economy

Little People and their Litter: Main Street Economics, Installment Four

Summary of bank slips I picked up off the ground outside the local bank ATM.

245.96

124.55 (Inquiry) [Do it do it take it all out!]

6192.41

334.06 (Inquiry)

5258.79

592.62

4522.55

635.43

Average: $2,222

Of course, the biggest indicator was the fact that some guy tried to rob the

bank 20 minutes before I got there. He handed the teller with a note saying he

had a gun. Guess the tellers were cooperating but he high tailed and ran away -

escaping on foot.

Previous results:

Average Balance on March 15,

2008: $4,259

Average Balance from Oct 24

07 $815

Average Balance from May 07

$100.87

11.11.08 Big uproar about the 'sad' Tent City in Reno

(Government-sponsored depression)

Tent Cities on the Rise Reno Nevada CBS news

http://www.youtube.com/watch?v=7-kq2w4N4eA

I noticed that Reno Tent city video article

mentions that the situation hasn’t been this bad in 23 years. That means

1985-6. I lived in Reno during those years and had various odd jobs

downtown. Those included door-to-door jobs. A few things I noticed:

The money I made I mostly blew on good times, booze

and drugs – but a portion I put into my education, tools and vehicles.

The education and tools paid off. Eventually, instead of partying every

day I was in m own house sleeping a split-shift so I could attend the

classes I needed while working overtime.

Most those other folks ONLY put their $ into booze

and drugs. I interacted with many of the guys on the streets. Their pay

would go to dime bags and a bottle.

Back then the church helped out those down on their

luck. Now the government is stepping in to fill the roles of the church

AND the private sector. This will ensure the recession turns into

depression – by design. See the financial sector as EXHIBIT A.

I competed with some of those baby boomers for

jobs. I remember those who last had a job in Oregon, pumping gas, and

were now trying for a Reno warehouse job. 23 years later, they are still

trying for the same job. What have they done to better themselves in

the past two decades?

Only difference between those folks and me is I put

more and more money (and effort) over time into education and tools (and

investments) and less and less into booze and drugs. Notice those in

the tent city watching TV? That’s what it will get you.

Personal choice, personal responsibility.

Funny, never heard those lines in the ‘interview’.

Though I did see plenty of crocodile tears from the

losers. Save it for the camera girls.

11.10.08 Why GLD Should Hold 733

Here is a good example of basic technical analysis. On the Yahoo 5-day chart you

can see why 733 is the number I used in my last post:

http://finance.yahoo.com/echarts?s=GLD#chart7:symbol=gld;range=5d;indicator=volume;charttype=line;crosshair=on;ohlcvalues=0;logscale=on;source=undefined

Notice how 733-ish served as the base for Mondays rally, resistance level last

wednesday and thursday, and a support level last Tuesday and Today.

On the two year and five year chart you can see why the 650-670 level

will/should provide longer term price support (draw an invisible lines on the

bottom prices since 2005), and why I think there is a good probability (40%)

that GLD could go to that level medium term (three months)

http://finance.yahoo.com/echarts?s=GLD#chart4:symbol=gld;range=2y;indicator=volume;charttype=line;crosshair=on;ohlcvalues=0;logscale=on;source=undefined

The 60% chance is that it goes up from 733, we'll see.

11.9.08 Live.com Rebate still at 25%

At the get-go, from the first round, we maxed out the returns. At the beginning

you could get $250 back per item but was limited to 3x transactions per account.

Then six per account. Currently you can get the rebate 12x per account.

A few things to keep in mind.

- There is a 2,500 cap per year

- If you sell the item before the rebate you may not (depends) get the rebate

back (there is a conflict between the ebay and MSN rules)

- If the seller returns any portion of your initial payment, you may not get the

rebate

11.9.08 Collections and Provenance

My stance is that once a fine collection is assembled, the current or assembling

steward (the 'owner') ought take a picture of such, and document for future

enjoyment.

there have been several very nice collections that I've seen broken up in the

last 15 years (including Sy Redd, Bill Harah, Fitzgerald, Liberty Belle, etc).

Even when the pieces are given a provenance for future owners (e.g. Redfield,

Binion, Fitzgerald etc.) the whole of the collection - the majesty and thematic artistry

directed by the original collector, is lost for good.

Does Texas have many un-patented gold placer claim properties available on the

open market?

11.8.08 AIG Fraud and Failure (Same 'ol Same 'ol)

Recently I shopped around for a new term life insurance policy.

thankfully AIG was not on that list due to previous

misconduct.

Northwestern did make my list. I had a term policy

for two years and cancelled. They simply lie at most every point

possible. Just this week I received notice that I am party to a class

action lawsuit against them regarding, you guessed it, sales and

marketing.

Ended up getting my term policy through Prudential.

Not even sure I'll stick with them. Term is so cheap, my last policy

through Prudential was 20% cheaper than with Northwestern, and that is

after I aged another two years.

What I am looking for now, and what most people do

not have even though they need, is disability insurance.

11.6.08 'Change'

Ho Hum. Dow down another 440 points. Worst presidential week stock action

ever and worst two-day action since the 87 crash. decades. El Prez. Barry Obama's first appointment is a petty

partisan operative.

Emmanuel served as a policy group-think enforcer

under Clinton. Like most other dutiful employees, he received a

turn of leisure and graft on the board of Freddie Mac.

And previous Clinton partners in crime Reich, Rubin

and Summers are eagerly rubbing their mittens together relishing yet

another shot to foist them into the public cookie jar.

So much for change.

11.6.08 An Email I would have written to Ray Luccia

If I thought he wasn't completely beholden to the powers that be:

From his podcast: Nov 6, 2008 at 50:56

Caller (Bob in Ct): “Where does the federal reserve

system get its money that it can then loan to other banks I guess they

do it as ‘overnight’ or ‘discount rates’.

R.L.- Luccia "They get it from the government

(taxpayers)."

They also get fees (from member banks

Do they pay anything to get this money

R.L. - "No"

Bob: "If they print it they inflate the currency

and they if they borrow..." (cut off mid-sentence by R.B.)

R.B.- Statement One: “You’re worried about stuff

you don’t need to worry about”

Statement Two: There are no shareholders in the

federal reserve. Nobody gets a benefit out of it as a share holder.”

My editorial:

Neither of you answered the Bobs’ question.

The answer that RB provide “general taxing

authority” is simply incorrect, very much so.

So my question to the brain trust, what exactly do

you have to lose by actually answering the guys question and stating

what the authority is for the federal reserve and how it works/

Are you worried someone will cancel your show?

Phil Grande gets away with it. Sure,

businesstalkradio dumped his show but bloomberg picked him up.

What's wrong with integrity?

11.5.08 Looks like the Market voted on Obama

Dow down almost 500 points.

Ca Prop 8 - requiring the state constitution specify that marriage is between a

man and a woman will never happen. The state supreme court will declare it, like

most of the will of the people, null and void and anathema to their particular

brand of authoritarian rule.

Obarry's first political appointment: ultimate insider hack job Rahm.

"Change"! Har!Meet the new boss, same as the old boss.

11.4.08 Sure I vote

Haven't ever voted for anybody that actually won, but sometimes the proposition

votes go my way.

Today I had the distinct pleasure of voting for someone with integrity (yes,

there were actually three individuals on the ballot with integrity. its just

that none of them were demopublican). I cast my vote for the very

honorable Alan Keyes.

A real man, with actual administrative experience, values and vision.

Most americans took the lazy route, voting for the one party system. Regrettably

they'll get the government they deserve.

10.29.08 Possibly the shortest long term trend:

Since 1950 worst 25yr period provided invested in

the S&P 500 yielded an annualized 7.9% rate of return (included

reinvested dividends)

10.28.08 Looks like that key reversal in GLD last week

held.

Buy one-third position now, one third position if

GLD breaks above 753 and another third if gold breaks 775

Set stops (half) at 733 and 710,

Sell one third at 808 and on third at 840. Hold the

last third and sell if it breaks below 733.

Bought one-third position in GDX now @18. MUCH

looser stops.

These are short/medium term positions only.

FWIW.

10.27.08 "gurus"

http://www.cxoadvisory.com/gurus/

Guru’s who

got the panic of 2008 more or less right):

Joe

Batattaglia

Jim Rogers

(called for FNM bankruptcy)

Peter

Schiff

Joe Morales

Phil Grande

Mark Faber

Fred Hickey

(Baron’s round table)

Bill

Fleckenstein (though it was through the stopped clock method)

William

O’Neill

Jim Rorbach

James

Deporre

Warren

Buffet

Mark

Leibovitz (Phoenix)

Jonax Max

Ferris

Jonathan

Hoenig

Lowries

(Power index)

Losers

(Who got the panic of 2008 wrong)

All the

rest

10.27.08 Pennsylvania Treasure

http://www.bbc.co.uk/dna/h2g2/A536573

When you can’t mine it, you have to find it.

10.22.08 Possible Key Reversal in GLD.

10.17.08 Rest in Peace Levi Stubbs

Saw the Four Tops about four years ago here in town. They still had three of the

four original Tops in the band. Sounded awesome. The Baritone passed away

just a few months after we saw them play, as I recall. Now their incredible lead

singer has passed on also. A great talent is lost, just about the end of an era.

10.15.08 The Cult of Corruption

A former Minerals Management Service employee blows the whistle.

The Government Inspector General backs his account

http://www.cnn.com/2008/US/10/14/oil.whistleblower/index.html

The Interior Department refuses to comment.

Of course the DOI refuses to comment. What

can they say? "Well, we tried to drag down every bureau to the

decrepit level of Bureau of Indian Affairs, we just need a couple more

years during the Obama administration to meet our goal".

My guess is they overshoot the goal, by a wideshot.

10.12.08 The Government almost

always Stages some Faux ‘Economic Crisis’

When the political leadership is ready to change

allegiances.

This allows the next administration to implement

the next piece of the draconian plan to remove your control over your

money, finances and government.

2008: Witness the ‘Financial Panic’

2000: Clinton Gives up the Ghost – Stock Market

Crash of March 08

1992: “It’s the Economy Stupid”. Rigged 1991

recession serves its purpose

1987-8: Artificial stock market collapse (though

administration retains control)

1978-80: Volcker system shock and Iranian Popcorn

Show lift unemployment and inflation

1976: Political Oil Embargo scam plays through; IMF

stages Great Britain sterling crisis

1972: US completely moves to a fiat monetary system

after the French challenge the ability of the US to pay its debts in

gold. US repudiates sound money – suspended any gold or silver backing

of currency. The paper financial demise begins in earnest.

1968: U.S. Congress repeals requirement for gold

reserve to back the U.S. currency

1963-4: Kennedy signs EO 11110 ordering US Treasury

to print silver-backed US Notes instead of Federal Reserve Notes. In

kind, Kennedy assassinated and US defaults on silver coinage. (To repay

the favor, the government puts Kennedy on the first debased half

dollar).

an on and on it goes same as it ever was…

The intervening years show much less socio-economic

and fiscal snafus.

10.12.08 The Current Financial

Crisis isn’t a Crisis at All, it’s a Systemic Breakdown

The Housing Crisis isn’t a crisis at all, it’s a

planned meltdown directed by the Clinton Administration, The Clintons

contrived a race relations panel in the 1990’s to hatch scheme to

increase home ownership among minorities, mostly blacks. The reason

more blacks didn’t own homes in the first place is because public

education system has taught lie after lie for generations, especially

regarding finance. As a result, the lower income individual, such as

those that rely upon public education entirely, had no sound financial

education or background. Hence, they couldn’t master the economic and

financial concepts that would allow for home ownership under previous

underwriting standards.

The powers that be forced Fannie Mae to relax

underwriting standards for the poor, especially urban poor, to get the

minorities into homes they couldn’t afford under mortgages they couldn’t

understand. The architects of this policy were warned of, and knew full

well, the ultimate end game their disastrous policy would play out:

Housing Crash.

Steven A Holmes and the New York Times laid it out

in 1999:

http://query.nytimes.com/gst/fullpage.html?res=9c0de7db153ef933a0575ac0a96f958260&sec=&spon=&pagewanted=1

10.10.08 Gold and Silver had been Holding up Very Well

Even with the recent strong rise in the US Dollar, until today. So, why

the smack-down in metal prices today?

Well, look at Goldman Sachs performance of late, and rumors their health is

becoming 'stove-up'.

Goldman controls the gold short positions. Knocking 20% off the price of

gold and silver helps settle positions over the weekend.

10.10.08 Heritage Galleries Issues their Don't Panic

Communiqué

"Collectibles, especially coins, remain extremely liquid. Over the last three

months, as Wall Street has been reeling, our auction and private treaty sales

have risen steadily. Every day people who are in businesses where capital is no

longer readily available turn to us for liquidity.

Our $35 million September 24-27 Long Beach Expo auction of coins and currency

registered more bidders (over 14,000 of them!) than any auction in our history

*Our number of successful bidders is up by 11.5%.

*Our number of lots actually sold in each weekly auction is up 39.95%.

*Our average lot value is up 8.49%.

*Our total sales volume is up 43.34%

Rare coin prices, along with many other collectibles, actually rose during the

Great Depression, as well as during the recession and accompanying real estate

and stock market collapse of 1974. During the oil crisis of 1979, we saw coin

prices rise dramatically, rewarding owners at a time when their stocks and many

other assets were plummeting."

10.10.08

Someone Left Me with a nice Bon Mot

“Just

remember, the only people that think gold and silver is a form of

payment is Goldbugs, you will have to find a goldbug grocer to get your

grocery's.”

Yes,

eventually EVERYONE becomes a goldbug. Its just that THEY become bugs

out of necessity, not foresight.

10.9.08 Suggestions from someone who really IS losing the

Family Farm:

Couple

things you might research:

1. Do you

know anyone with dough who wants ownership – but not necessarily

possession - of the property? If so, then look into an All-Inclusive

Deed of Trust and a wraparound mortgage.

2. Farmland

Conservancy Program.

Some states

have this, some don’t. Essentially, the family sells part of the land

as an easement to the State – the state grants occupation and use of

land for some time, often until death of original owner.

In some

cases when a family cannot access Farmland Conservancy money’s the

Nature Conservancy and can access the money and pay it to the family as

cash. However, the Conservancy owns the farm and the family typically

can farm the land up until some date and they must then vacate.

3. If you

have no heirs, how about putting the land in a Charitable Remainder

Trust? If not actively farming, then lease out the land ( or water

rights + fallow land as carbon credits)?

Just some

thoughts…

10.08.08 Someone Tipped Me Off

Today is the feast day of St Andronicus - patron saint of silversmiths and

argentiers

10.7.08

Everything Runs on a Cycle,

Some are

better understood than others,

Many moons

ago i lived in a communal situation at college (54 students in four

co-joined open-floor houses -14 people per house).

An alpha

female would set the cycle. all the other women in the house would

follow her rhythm. this works up until there are five, six at a most,

women in the house.

Above that

number and a second alpha female will emerge and set the cycle for own

pack. the second pack is typically smaller. one thing that i noted was

that the second group seemed a more cohesive bunch than the first group.

Even more interesting, the women reported that apparently the alpha

female could change within the group, though I cant remember (nor sure

they ever told me) how they would figure that out if everyone was on the

same cycle.

There is

also a small percentage of women who will not follow an alpha's cycle.

interesting stuff, herd behavior at the base. occasionally we would all

discuss such group behavior en masse, so the above aren't just my

observations alone.

The guys

rather enjoyed the predictability. When that week onset, we generally

wouldn’t hang around and instead would socialize in the other three

houses. I imagine that this particular quirk of human biology helped

establish the first hunting parties (now down to just guys weekend out

or ‘poker nights’)

I have

never really read or heard much about this phenomena - don't think its

very well studied nor have others indicated much familiarity with the

topic. Compare search engine results for menstruation study with

‘cholesterol study’ or ‘smoking study’. Fascinating. Some hold the

position that womens health issues are under studied/funded, I tend to

agree. fwiw.

Years ago

they studied cycles in the nunneries. The nunnery studies may be double

blind, but the wrong pool. No Sex and no testosterone in the

environment effects the menstrual cycles. Additionally, the age bands

and their declining estrogen/progesterone levels - especially in the

alpha, cannot be discounted.

10.7.08

Went to a Stamp Show Yesterday

wow, was

that place moribund. actually drove there for the pinball fest next

door. best in the nation in just their 2nd year. their attendance was

up perhaps %100 Year-Over-Year. Kids, families, etc. Interesting

to see the pinball resurgence. A real and sensory game, not a video

illusion.

stamps on

the other hand, not sure what would bring that back? 18montsh-2years ago

I thought the hobby had a chance at resurgence. if not now, in another

20 years will folks really clamor for more govt paper? Perhaps the same

with baseball cards. Who cares about the overpaid cheats and criminals?

The innocence is gone and now so it goes with the denial. perpaps the

little giants (citizenry) is awaking from the slumber, and hungry for

the real deal.

10.05.08

You Ever Seen one of the Early american Card Decks?

The good

citizenry didn't believe in royalty so the decks had no jacks, queens

kings. Instead generals, pols and diplomats, etc.

saw one

displayed at this house maintained by the Colonial Daughters, the

Octagon House in San Francisco. Fascinating place. They had an early 7

dollar continental note. Also had a card game I had never seen or heard

of before (forget the name right now). I asked the ladies (both well in

years), they replied they had never known anyone who new how to play the

game. The layout looked similar to a Faro table, for those of you also

familiar with that game of yesteryear.

They asked

me to come back and give a talk on US monetary history.

10.4.08 From Poverty to Riches and Back Again in Two

Generations:

John Lee

Hooker owned a home in Vallejo, Ca , that he subsequently gave to his

daughter. She is about to lose the home to foreclosure. The

house is just a few neighborhoods away from mine. Frankly, the

construction isn’t so hot in his neighborhood. Our house was constructed

MUCH better. For that matter he should have bought a Victorian downtown.

I saw John

Lee play at a small show, maybe 100 of us there, a couple years before

he passed away. The guy still had the passion. Wonder how the other kids

are doing? Maybe he should have taught them basic finance in

addition to the 12 bar blues format.

http://www.timesheraldonline.com/news/ci_10637991

10.3.08 yep, as predicted - they blew the bailout down our

throats

and down our children's throats, and our grandchildren's throats...

Don't believe the hype. Only reason they passed this monstrosity is b.c. they US

Senate and most congressmen are owned by foreign financial interests. These

foreign interests are now demanding we pay back the loans. This was just a

starter package. A 'teaser rate' if you will. You know, deep down, what

happens next.

10.1.08 October is Here! The next three months...

...will be unlike any you've ever experienced so far.

Bailout:

Damned if they (90% they will), damned if they don't (10% chance of that)

The original three page abortion proposed by Paulson has now grown to over 150

pages. wOW, how did they write so fast? (har har, these provisions of the

Financial Patriot Act {and the provisions of the next bill and the one after

that} were written monhs ago).

If they do, We are de facto socialist country - in debt to foreign

masters (now its just you in debt, after the bill its your children and

grandchildren).

If they don't, The foreign masters will make a house call, on our soil.

The Triangle Attack:

In symbol, number, and design - the next hit will cut deeper than initially

appears.

Uncertain Election Results:

The past two elections were simply dry runs for the

Of course, and as usual - hope I am wrong.

9.31.08 Price of Gold vs. Price of Stamps

http://www.runtogold.com/Run_To_Gold/Run_To_Gold_Blog/Entries/2008/6/27_Cost_of_USPS_Postal_Stamps.html

Note that the credit squeeze of the 1950's was followed by the inflation (guns

AND butter) of the 1960's.

Will the cycle repeat/spin?

9.30.08 The Bailout Shall Return

Just a matter of time, likely days. The further bailout shall be named

Osama.

The current name of the bailout (thanks to Lew Rockwell):

[On Concurring in Senate Amendment With An Amendment]

BILL TITLE: To amend the Internal Revenue Code of 1986 to provide

earnings assistance and tax relief to members of the uniformed services,

volunteer firefighters, and Peace Corps volunteers, and for other purposes

http://clerk.house.gov/evs/2008/roll674.xml

9.29.08 The Company Turns on its Own

Former CIA #3 gets ratted and rodded.

WASHINGTON (Reuters)

"The CIA's former executive director, Kyle "Dusty" Foggo, admitted

steering contracts to friend Brent Wilkes, who already is serving a

12-year sentence for bribing former Republican Congressman Randall

"Duke" Cunningham, the department said.

It said Wilkes, a one-time Republican fundraiser, had made Foggo a

standing offer of a high-paying job, and the two hid their relationship

from the CIA and used shell companies to conceal Wilkes's interest in

the CIA contracts."

http://news.yahoo.com/s/nm/20080929/ts_nm/us_cia_contracts

In gangs, like the CIA, the capos lose their jobs AFTER they lose market turf

(drug routes and banking accounts).

CIA is getting outcompeted all over the globe. I saw them lose drug turf

in the 80's and 90s. Now they're losing their money laundering accounts.

Makes sense, US banks, manufacturing, media, entertainment and currency are all

losing market share. Their govt. criminals are also more efficient than our

govt. criminals.

9.29.08 The Bank Runs Continue

In the US, Iceland, Europe, and now begin in Asia.

Bank failures are not great, but NOT letting them fail provides an even worse

alternative.

9.29.08 The Bailout

It ain't about the money, its the principle. Are we a socialist or capitalist

country. What's a lousy 700Billion on the installment plan anyway, we just

passed 600B for the DOD and another 25 B for the car manufacturers in the past

week.

Ok, maybe it is about the money - like who gets to skiim off the top first...

9.27.08 Bank Runs Fail due to Stupid Depositors

This quote made me laugh out loud: "

"We came to

pull (money) out, too. We have a business, and we have a lot

of money in there, but we're safe. She (the bank teller) told me

it's guaranteed, and I believe her. She's a Muslim, I know her

and like her, and it's Ramadan, and you're not allowed to lie on the

holiday."

http://www.timesheraldonline.com/news/ci_10576372

9.26.08 Physical Gold

Shortage: US Mint Runs Out of Gold Buffalos

http://www.ft.com/cms/s/0/e8bc3d72-8b40-11dd-b634-0000779fd18c.html

9.25.08 Chinese Fake New Story About Mission in Space

Oh no, the chinese propaganda outlets lie too?!?

http://www.telegraph.co.uk/news/worldnews/asia/china/3082804/China-fakes-reports-from-space.html

9.24.08 Of Course the Bailout will Pass and Succeed

The intention is to destroy what is left of our capital markets. In that

regard the traitors will succeed. The destroyers on the capitol hill warn that

should we not bail out the criminals on wall street, then a recession will

ensue.

All the chest beating and histrionics before the bill is signed simply provides

some sound bites that hapless pols can use in their nest election cycle to show

'how they were against the bailout from the beginning" (before the screws got

turned).

A recession is NOT a bad thing, it provides a necessary and beneficial

opportunity for the market to wean out excesses and weak hands so that another

boom may follow. However, Greenspan had orders to make sure that there was no

recession. by putting off these normal corrections, the excesses build to

a point where extreme fluctuations follow, eventually leading to an inevitable

crash.

9.23.08 The US Mail moves Slowest at the US Government

Headquarters

Congress irradiates its mail, slowing up an already slow and cumbersome process.

They want to make sure that only US-manufactured anthrax gets through the

screen.

9.23.08 The Financial Patriot Act (700+Billion bailout

bill)

Just like the patriot act, this bill was prepared months ago but was presented

to congress at the point of a gun with a full court press by the white house.

The mainstream press sits idly by, complicit to the crimes.

"White House Deputy Press Secretary Tony Fratto... insisted that

the plan was not slapped together and had been drawn up as a

contingency over previous months and weeks by administration

officials. He acknowledged lawmakers were getting only days to

peruse it, but he said this should be enough. "

http://www.rollcall.com/news/28599-1.html?type=printer_friendly

Same old playbook.

Let's examine some of the proposed lowlights...

Demands on the Taxpayer:

- A minimum of $700Billion (will grow to over 1Trillion), enough to saddle every

person in this country with $37,000 at the moment of their birth (in a addition

to all the other debt and entitlements currently estimated at a mere 48

Trillion). And no, this does not count interest.

- Millions of $ in Bonuses to CEO's who oversaw the largest financial failures

in written history.

- Paid welfare to the largest donors to the political campaigns of the current

Senate Finance and Banking Committee member.

Naturally, The plan demands NOTHING from these firms in return. The Treasury

Secretary will control over 1Trillion and will be accountable to no one for how

he spends it.

First things first, Paulson will fork over Billions of Dollars, taken from your

pocket, and give it to Goldman Sachs. Yes, for those keeping track Paulson the

current Treasury Secretary was a former Goldman Sachs CEO. His main job is

to line th epockets of his previous, current an future boss - GS.

The US senator plan on driving our once proud republic into a socialist

oligarchy in one week.

Yep, I listed to almost two full hours of the tripe this morning. Paulson's

wretched opening statement, all 21 senators rushing to say how "obviously,

something must be done immediately (meaning they will vote for it this week)

aka: but first, time to get some more pork into the pipeline and secure my next

job at Treasury/Goldmans Sachs/Morgan/Bear

One more time, the backgrounder:

The government creates the problem so that they can propose the solution, and

the problems perpetuate whilst ht etax rate crawls skyward.

Government programs rarely work.

Johnson's "great society' did not solve poverty in the US. It did, however, draw

out 15 trillion from working and solvent us households and bloated bureaucracy

to the point we see today.

Once government intervention enters the market place, the end result: failure,

becomes a certainty. The only speculation point is the time it takes to get

there.

The senators today, to a man (if there were any around) all stated "well of

course there needs to be more regulations, just not today".

Government intervention and the resultant regulations worsened the state of

markets into we devolved into the sad basket case we are today. The government

created a housing mortgage monopoly in FNM and FRE. They both, inevitably,

failed.

The government created the Community Reinvestment Act, which essentially forced

debt on urban workers without a sound financial education, much less the down

payment on a house they couldn't afford the payments on. Research how

Obama and his ACORN cronies pushed the debt into every nook and cranny they

could, creating a great contribution to the current mess.

Look at how badly the government screwed up this week (and the week before that,

and the week before that...).

The SEC and the Fed conspired to remove the uptick rule, in existence for almost

70 years - installed to prevent market excesses during the great depression. Why

did they do that? (A: to wring more money out of the horse they were riding unti

it finally gave up the ghost).

Yes, the same SEC that force fed a fire sale of Bear Stearns to their comrades.

They got the assets, your children get the debts.

But hey, the former SEC chief sure got what he deserved. Can you imagine paying

money to a woman for sex. OMG, what a complete shocker, The criminals running

our banking system into the ground get million dollar bonuses of your money

(they already lost all the shareholders money and need a new host to suck dry).

You probably didn't even see the 180 degree reversal that the Fed had regarding

eliminating short sales against the financials. These same financial companies

had been naked short more gold stock shares than ever existed, fore years. they

just kept rolling over contracts into future months. But once they got a taste

of their own medicine (folks shorting the financial sector) they changed the

game in the middle to prevent short selling against their fair skinned babies.

Yet, they realized their gross stupidity and reversed the policy within a week.

The Wall Street Bailout Bill - a Financial patriot Act on Steroids. With the

Patriot Act, you just signed away your freedom. With this new act you are

signing away your first born. All with a hope that you will draw your pension

before your firstborns, justifiably, murders you in green blood.

One thing is for sure, the people get the government they deserve.

9.22.08 The Fed Waved Their Wand and Decreed that Goldman

Sachs and Merrill Lynch

were not longer mere investment banks. Nope, just like that - overnight - on a

weekend they became commercial banks. and are now able to accept 'deposits'

(more likely emergency funds of taxpayer cash) to shore up their flagging

fortunes.

And to think it takes me 10 business days to clear a check...

9.22.08 How Come the Senate Never Shored up Fannie and

Freddie When they Had a Chance?

Probably b.c. they were on the payola.

"Throughout his political career, Obama has gotten more than

$125,000 in campaign contributions from employees and political

action committees of Fannie Mae and Freddie Mac, second only to

Dodd, the Senate Banking Committee chairman, who received more than

$165,000."

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aSKSoiNbnQY0

9.20.08 Marshall vs martial law.

A play on

the Marshall plan. Back when we had the strength and temerity to force

our currency on the poor colored countries. The Marshall law will work

in the reverse. The poor countries will enforce their standard of living

on the formerly united states.

Remember,

the corner office is nice – but only as nice as the view outside…

9.20.08 Outlawing elements, oh most certainly not dear

serf.

We only

intend to ‘draft prudent legislation’, ‘formulate sound fiscal policy’,

and ‘promulgate fair regulations’ so that the economy doesn’t crash and

you don’t lose your job. But mostly, we love you and want what is good

for you. After all, if you don’t own Au bullion (as most plebes don’t)

then what do you have to fear/hide? Only the gold-selling terrorists

will be ‘regulated’.

Of course,

the ag/au elemental regulations are just a trial run for the big one –

carbon.

When the

Metals (as bullion) are Again Illegal

Yes, the

Powers That Be (PTB) will again make gold (bullion) illegal to sell (but

probably not illegal to hold or use as to allow for industrial

applications).

That black

market will make the metal even more valuable. In fact, the current

disconnect between the paper price and the true physical metal price

(not to mention availability) already forecasts that future reality.

When the bullion is made illegal (more specifically, price-fixed to the

new currency) there again will be an official rate and a trading price.

Those not honoring the 'official price' will be charged as 'criminal

terrorist unofficial money launderers'.

My current

supposition is that plat will not be monetized again but silver MAY be

(though probably not in the way we expect). We’ll go forward (not back)

to a bi-metal system. The PTB then play the Au/Ag and commodity/paper

arbitrage for the foreseeable future (the 'official criminal money

launderers). Look at how Ag/Au prices have traded out of sync just this

week!

The

government will make gold bullion illegal to own, but ‘agree’ to buy

everyone's at higher prices.

That’s a

good start, for sure. The powers that be will continue to short paper

gold down to 650. meanwhile physical Au, if you can find it, trades for

$1,200.

Then the

gov offers a GREAT buyout at 10% over spot, offers to buy physical gold

at $715 and floods the press with bon mots about how everyone made 10%

and how happy you should be to receive that level of return in these

'uncertain economic times'.

everyone

who refused to sell goes to prison, or worse.

9.17.08 Govner Arnie of California grew a pair today.

Really.

Stated he will veto the state budget passed yesterday by the legislature. The

budget of one of the worlds largest states. If only the legislature would

decrease as fast as the budget.

My favorite quote of the day, by the semi-honorable and semi-honest (at least

today) Nevada Senator (D) Harry Reid (speaker of the house):

'..there will be no legislation from congress this year on the financial

situation since nobody in congress knows what to do..."

well, that never stopped them before!

9.17.08

THE PANIC OF 2008

Today,

9.17.08, the Bond Market crashed as the 13-week T-Bill yield crashed,

the largest decline in over a half-century.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aCMdnmwJqCaM&refer=worldwide

Here’s the

visual:

http://finance.yahoo.com/echarts?s=%5EIRX#chart1:symbol=^irx;range=3m;indicator=volume;charttype=line;crosshair=on;ohlcvalues=0;logscale=on;source=undefined

Regrettably, as the US and Russian governments panic due to significant

declines in their equity markets, they make the same mistakes.

International fascists and the nationalist communists are executing

(poorly) the same playbook by trying to hyper inflate the crashing

state-sponsored enterprises. Regrettably, the deflating bubble

burst seams on all fronts and the populace stateside begins to panic.

The large and dumb money crashed the T-bill while the semi-smart flee to

the shining shield of precious metals.

Gold rises the largest amount in recent (250-year)

financial history.

Still, I don't get it. All this talk about

difficulty of settling derivative books with each other.

Why don't Russia and the US trade state banks and get is over with? a

fair lose-lose trade for everybody!

Oh well, wonder what’s on TV tonight…

9.17.08 Personally, moved no money nor made any trades this

week

completely comfortable with our positions and distribution.

feels good, like having a wee bit of physical stashed away somewhere...

9.17.08 A Week of Incomparable Financial and Physical

Storms:

An island of gold amidst a sea of paper panic...

9.14.08 The Crisis is always

announced on a Friday, and Solved on a Monday

Fascinating how they only need 48 hours to solve

all the worlds problems.

Except this time...

9.14.08 Nixon’s price

controls:

August 15th, 1971. Sunday Night.

9.14.08 Back in the good old

days (free markets)

$10,000 gold certificates were issued directly by

the US Treasury in 1882, as bearer instruments. They traded

infrequently and mostly to settle accounts between banks. These

certificates did require that the Treasury maintain the issued amount of