Follow

us on Facebook or Twitter:

Follow

us on Facebook or Twitter:

Follow

us on Facebook or Twitter:

Follow

us on Facebook or Twitter:

WHY BUY BULLION or COINS?

Rare coins: The mindset that separates the spare change in your couch from the investment in your children's future.

Why Buy Gold Bullion?

Why Buy Silver Bullion?

Why Buy Numismatic Gold?

Why Buy Numismatic Coins?

Gold Bullion and Silver Bullion as Investment

"The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Deficit spending is simply a scheme for the 'hidden' confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard."

- Alan Greenspan. From: Gold and Economic Freedom. 1967.

GOLD IS: Rare, Portable, Durable, Malleable, Fungible, Divisible, Desirable, Liquid and Political.

Strategic Asset Allocation

Does you portfolio contain true diversity. Do you think that stocks, bonds and cash cover all the bases?

Balancing diverse asset classes provide different correlations to maximize returns and minimize risk. Many investors hope that their portfolios are diversified simply because they hold these asset classes: Stocks, bonds and cash. Those that have some real estate, perhaps their house or a publicly trade Real Estate Investment Trust, may mistakenly feel that they have fully diversified their holdings.

However, true asset allocation diversity should include such varied asset classes as: Commodities, precious metals, collectibles, raw land, foreign currency and derivatives.

How many investors’ portfolios include these asset classes? Gold, especially bullion, provides the easiest entry into this field. Furthermore, gold is the most negatively correlated sector compared to performance of stocks, bonds and cash. That is, when stocks, cash and bonds are doing well, gold typically under-performs. The reverse is also normally true where gold will outperform when the other three asset classes are not performing. As such, holding gold in the portfolio, between 3 and 5% provides good risk hedge and diversity.

A study performed by Ibbotson (2006), commissioned by the great bond house, Pimco, showed some fascinating results. Bonds and stock in the past had previously provided negative correlation, and therefore a portfolio holding both previously afforded diversity. Not anymore. Namely, all assets denominated in fiat dollars share the same systemic risk. Commodities offset that systemic risk and provide true portfolio diversity.

Inflation and/or Currency Hedge

Investors use Hedging to offset various investment risks. In some respects hedging provides an insurance policy against downside action to reduce the severity, not the possibility, of a capital loss. The philosophy here is that you set aside 10% of your wealth in precious metals and hope the metals investment performs poorly and everything else does well. In this instance gold provides a hedge; if the 90% of your wealth performs poorly because of some systemic risk (depression, currency crisis, etc.) the gold will outperform. In a nutshell, this hedge behaves as an insurance policy that you hope you never have to collect.

Store of Wealth

Monetary inflation, often expressed via tightening money supplies, results in higher interest rates. The higher interest rates make the cost of borrowing money more expensive while simultaneously raising the rates that bonds pay. For instance, in the late 1970's and very early 1980's the rates that banks charged on loans went into the high teens. The rates that bonds paid also rose, BUT they did not match the amount it cost to borrow money nor did it match the rate of goods inflation, the amount of goods such as groceries or fuel that a currency can purchase. So, in real terms, the purchasing power of the individual American had been declining. As such, money flowed into gold since gold has held a relatively stable valuation in relation to cost of goods over the previous 5,000 years.

Gold in 1789 was $20.22 an ounce. In 1933 gold was still $20.22 The

lesson here is that the US Dollar, when denominated in gold, did not suffer

inflation. The inflation began when congress formed the federal reserve to

create monetary inflation, and destroy the US Dollar - substituting a private

system of fiat and debt in the Dollar's place. Of course today you need over

$650, $870, $945, $1150

$1300 to buy that same ounce of gold. That is, the federal reserve had almost met

its mandate to destroy the purchasing power of your currency.

In fact, if you compare the price of a house and car in 1970 compared to comparably houses and cars today, you will find that you need more gold to buy the same amount of car or house. Gold is the real measuring stick against which all other values are compared. Cars and houses are cheaper than they were two generations ago due to several economic factors. For instance, today's cars do not need the same amount of steel but still provide a better safety factor and performance. Houses are simply made of much cheaper materials and are of inferior production quality.

This flow of money into gold serves as demand. Increasing demand for a fixed amount of gold caused increased price; indeed the price of gold skyrocketed throughout the 1970's ending in a blowoff top in 1980. (Though interestingly, even though there was a small spike in numismatic gold in 1980, there was no blowoff top. However, the numismatic gold did exhibit a blowoff top in 1989 even in the environmental of moderately calm gold markets.

Fungibility

Fungibility means that one piece of gold is the same as any other piece. This also makes gold (and the other metals) untraceable (which is why governments do not like citizens holding gold). Why is this important for a currency? It guarantees anonymity for those holding money and conducting commerce.

Economic Preservation

Liquidity

Once I had a conversation with an insurance salesman who told me that the policy was so liquid that I could have my money out in three days. I asked: calendar days or business days? He replied business days. What if there is a federal or state holiday during the interim. Or worse yet, a banking holiday. I then explained my definition of liquidity:

The ability to take 100k USD on Monday morning at 7am in NYC, put it into an investment, put that investment in my pocket, take that investment out of the country, sell the investment and get my 100k USD in another currency - cash, by the close of the business day.

How many investments allow this scenario. Only one I can think of: Gold Coin.

Transportability

Silver bullion is so heavy that a small home

safe filled with melt/junk coins would require a forklift to move it.

Once I was talking to my former neighbor a couple years back. He was supposedly considering taking some of his losing stock positions and putting them into precious metal investment but was concerned about storage. I told him he could put several hundred thousand dollars worth of gold bullion (and especially coins) into a plastic container about the size of a loaf of bread, and that he could put the container in a small day-sized backpack and go anywhere in the world. His eyes opened a bit as he considered the possibilities...

Privacy Concerns

Investment and/or Speculation

Supply and Demand

Fundamentals

Past Performance

There is no new supply of rare coins

The mint simply isn't making any coins from years other than the one we are in. There will never be another production run of the 1916-D mercury dime, except by private mints as curios or by forgery. Hence, the numismatic community will forever adjust to the supply of 264,000 dimes that were minted by Denver in 1916. And even then, the supply has been further diminished by the silver rush of the 1980's when countless millions of coins were minted down since their intrinsic value had exceeded their face value ('ten cents').

The state of coin conservation fluctuates

Through attrition, melting of coins during increase in bullion prices, and simple loss through the vagaries of commerce, that supply will only decrease throughout the years. Further, the supply of high specimen states of this fixed population will also continue to decrease. For instance, although that dime may not be lost under the front porch, it may be mishandled through an accident or ignorance of proper coin handling and preservations such that the grade of the coin lowers a step or two over the years. Granted, many valuable coins have increased value due to surface toning which increases eye appeal and investor demand. Furthermore, many of the higher value coins now are now preserved in various types of curation or preservation methods such as plastic holders ('slabs').

Increasing Price of Gold and Silver

It's actually easier to buy high and sell higher than it is to buy low and sell high.

[That tidbit alone is worth the price of admission!]

When the price is low, there is no interest in the market and therefore difficult to sell. When then the price is rising, interest in the market increases as new individuals enter the market who had previously not considered bullion. Also, 'hot money' and investment professionals looking to show positive return will play the market. This attraction of new investors drives demand. Since the supply is fixed, the price must rise. In turn, this encourages people already in the market to invest an even higher percentage in the market. The infusion of new blood seeking bullion creates a greater marketplace and thus allows you to sell easier with a lower vigorish.

Commodity Cyclicals

Generally, those who consider gold (or silver, platinum, palladium) as an investment consider that the investment potential arises from the metal value as a commodity. Commodities, such as metals, grains, cotton etc. trade in cyclical and secular shifts like all other financial holdings. Commodities often rise in price to reflect a growing economy with increased consumption patterns and behaviors or to signal monetary inflation. Conversely, long and stable periods of moderate growth with well predicted and met commodity production will moderate volatility in commodity prices. Going long and strong when bullion metal and commodities and numismatic enter a bull market together is a type of tactical asset allocation. This tactical allocation could increase your exposure from the 3-5% recommended during standard economic cycles up to 20% or more depending upon your risk quotient.

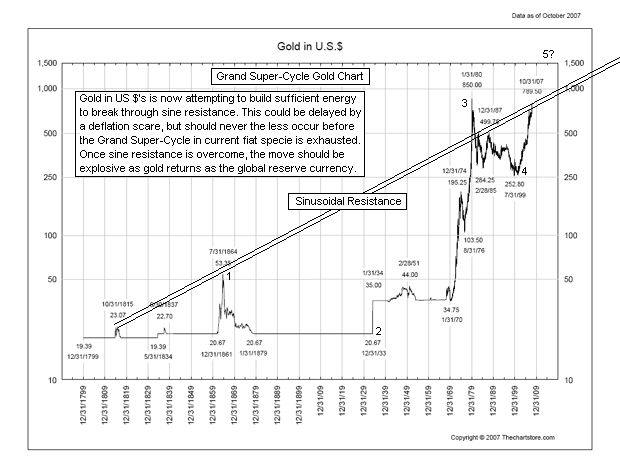

Commodities and metals have entered a long term bull. Previous commodity bulls have performed for an average period of about 14 years. Metals, when acting as a currency rather than a commodity, perform with an even longer bull cycle. In January 2000, CoinMine determined (see the blog) that metals entered both a commodity and a currency secular bull market.

The last currency bull market in gold peaked in 1980. This chart shows the daily close for January and February of that year:

http://stockcharts.com/h-sc/ui?s=$GOLD&p=D&st=1980-01-01&en=1980-03-01&id=p18965957081

Note that many pundits in print, on TV, the radio and the web working for the powers that be try to keep you out of the gold market by harping that gold has been a bad investment since it topped out and has been at a lower price since 1980. Therefore anyone who held gold since then has lost money.

Of course, this is only true for those who actually bought at the top!

As you saw in the above chart, there were only five days you could have bought gold above $740 an ounce in 1980 and only three days you could have bought over $800 an ounce! The weekly charts provide even lower price averages over this time frame. So, unless you bought on those five days at those levels, you likely have paid less for your gold than at any other time in the last 250 years, in nominal (face amount) terms. In terms of inflation adjusted prices, gold is STILL cheap (as of December 2007)!

Whey then, do the pundits try to keep you from owning gold? Let's put it this way, they are paid to work against you. Hope that isn't the first time you've ever heard this fact. If it is, congratulations on learning it the easy way by reading it here. May this lesson save you pain from this point forward and may you learn from others' mistakes - you don't have time to make all possible mistakes yourself on this planet. So learn from us, we've already made the hard mistakes for you.

Constant Demand

"In the system as it has evolved, gold has become a pillar of stability and faith in the dollar is on the wane. Historically, gold has been used as money either for trading purposes or as a reserve asset. The United States wants to move away from gold as the core of the international money system based on reserves and par values. But, it is extremely difficult to convince the creditors that another structure should be built based on managed currencies or SDR (Standard Drawing Rights- ed.) when the 'managers' are mismanaging."

From: The International Monetary Crisis. Committee on Finance, US Senate. Russell B. Long. Chair. May 1973.US Govt. Printing Office.

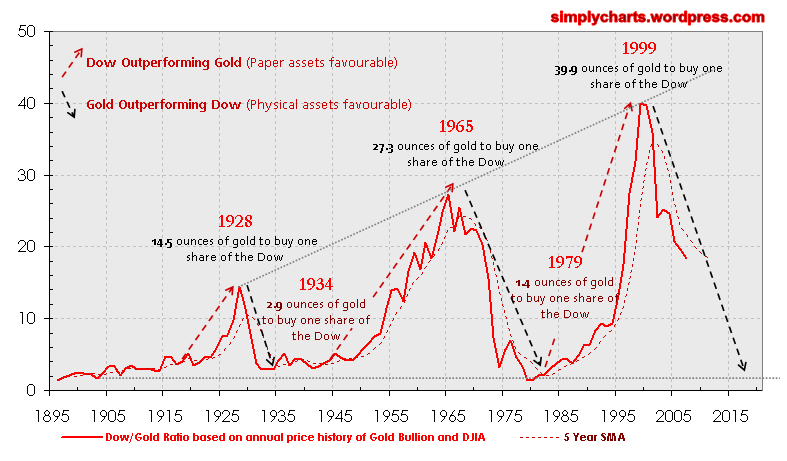

Because gold entered a secular bull market as a currency, it has appreciated against ALL the fiat combined in the SDR basket. Additionally, gold has outperformed all the bourses (markets) that are denominated in fiat. Comparing the Dow/Gold ratio, for example, provides a visual illustration of this phenomena.

Increasing Price of Gold and Silver

The current 4 -year and 8-year bullion price cycles, Krondateif waves, business cycles, credit cycles, fundamentals and demographics ALL support higher silver and gold bullion prices. Deflation is the primary factor working against an increase in purchasing power of bullion in gross terms, but will increase bullion purchasing power in relative terms as the value of other asset classes fall (equities, bonds, antiques, non-agricultural land etc.). These cycles are actually independent of the decline of the US Dollar. Bullion is increasing price performance and capacity against all other asset classes, type of pretty pictures and ink on government paper notwithstanding!

Why Buy Numismatic Coins?

Why Buy Numismatic Gold?

Coins as Investment

Supply and demand. There are more and more collectors chasing coins that will never be made again. In fact, some subset of any given coin series is lost every year to fire, theft and removal from the market, melting for scrap value, and simple loss to the ground from which it came.

My favorite chart in the whole wide world:

https://www.us-coin-values-advisor.com/rare-coin-values-index.html

Compare that chart to, just about anything…

At one point I thought maybe recession (2001-2002) would hit key date index similar to how precious stones and very high end coins take a hit. But hasn't yet happened. To my pleasant surprise. We'll see what happens in the recession of late 2007...

Dr. Lombra, with Penn State, conducted a study - funded in part by the Industry Council for Tangible Assets. Dr. Lombra determined that over the 25-year period of study the rare coin returns exceeded those of equities indices over the same period. Unfortunately, the study did include some flaws, such as not examining difference in tax treatment, transaction, and storage costs between coins and other asset classes, and especially how thin the market is for some coin issues. Nevertheless, the findings that investments in rare coins is negatively-correlated with others asset classes, especially fixed income, provide anther reason for holding coins as part of a well-diversified portfolio.

Even more fascinating is the work conducted by Robert A. Brown, Ph.D., as published in the Journal of Financial Planning and elsewhere. Dr. Brown discovered that over the ten-year study period, coins were negatively correlated with the equities market, which had been in a secular bull during the study period. In other words, the coins went down as the stocks went up. However, over the entire 62 year period of study the coins had provided returns that were very near the return of the equities, around 10%.

Hence, coins have a higher return per level of risk than many other investments over the long term, provide negatively correlation with with interest rate-sensitive investments including bonds and collateralized mortgages over the long run, and provide negative correlation with equity losses over the shorter term.

Bottom Line:

When the silver bull comes around again, and the lines are again out the door and one the sidewalk, if U wanna sell a few hundred pounds of silver. Take a number.

You wanna sell that coin on everyone's "gotta have" list, go to the front of the counter…

Privacy

When purchased right, nobody else will ever know you own gold, silver or coins. You will not be subject to confiscation for those coins that the government doesn't know about.

Tax Advantages

In California, coin purchases over

$1,000 (bumped to $1,500 in 2009) are tax free. In Nevada, you pay taxes

on the coin purchase but can eliminate this tax if the dealer ships direct to a

California address. Coin profits are taxed at capital gains rate, but only

if you sell. If you trade for like kind, or give to your estate, there are

no taxes payable. In other words, you can trade in and out of rare coins and

defer those taxes onto future generations. This is a standard hallmark of

estate-planning. Gifts to estate or under the gifting laws (up to maximum yearly

limits) avoiding unnecessary probate costs and time and estate taxes.

Affordability.

Any coin collector can simply begin by sorting through

pocket change, in fact most do.

Beauty and uniqueness

They no longer mint rare antique coins. The coins currently minted do not hold the appeal, and certainly the history, that attracts collectors to the hobby.

Growth Market

The recent changes in the numismatic and currency issues, especially the new US State-quarter program, has introduced literally millions of new and young collectors to the hobby. The US Mint estimated that up to 100 million Americans were collecting state quarters. If only a small percentage of these new young numismatic hobbyist stick with the pursuit, the sector will boom based on this increased demand alone.

Liquidity

Here is the true test on liquidity. Buy something in one

country on Monday. Get on a plane. Sell it Tuesday on a different continent.

Could you find a buyer, offering cash, at market spot, without using a broker?

For coins and bullion the answer is YES. For practically anything else (legal)

the answer is NO.

Bullion costs spreads are rather tight. For numismatic coins they go up an extra

%5-40. Coins are in a major bull run right now. Bullion typically trades flat

for years, with a crazy 18month period every once in a while.

Coins are legal tender

According to the Coinage Act of 1965, All coins issued by the US Government are legal tender. This classification includes coins (such as trade dollars and gold coins) that had been previously been demonetized via other acts.

Face Denomination

The value of half dollar is always a half dollar. The intrinsic face value will not drop below that. The underlying bullion value and the overlying numismatic value will overly the intrinsic face value. During the 1980's the underlying bullion value of 'junk' silver coinage (20th century) rose higher than the face value. As such people sold to dealers who then sold to smelters who then melted the coins into bullion bars. That supply is gone and will never come back into the market. The junk silver remaining was bought at the market top and will only come back into play at silver prices several multiples above where they have been for the last 20 years. The time to sell will be into the next run-up.

Transportability

More than one man has started a life anew after crossing a continent on a train or the ocean on a ship with nothing save the the clothes on his back and the gold in his pocket.

Coins, and all precious metals, are the ultimate store of value. A value that few others will know you have unless you show them (and that is a big part of the fun!). That gold or silver coin is a portable package that contains the wealth of the earth and the labor of man. A concentrated parcel of real estate.

Let's examine, very briefly, what is required to produce a one ounce American Eagle. (For a fuller explanation link to: Mining link). A miner must hire a certified geologist, with the attendant years of higher education, and a drill rig and crew to develop exploratory borings. After numerous attempts, lets assume our miner gets lucky and fines gold ore at .010 grams per ton. Assuming that the current market price of gold (and a host of other factors such as price of power, local political conditions, environmental permitting, geography, accessibility of the ore, price of power) allow for feasible mining, our miner must then either raise private financing or gain a loan from a bank. Of course, our miner must have written a decent business plan and assemble a d team of financial and geologic professional assemble ad a board of directors before even approaching the financial institutions for backing. Then the next phase of real work starts: permitting, grading, slabbing, building, and hiring.

Intrinsic Value

Your coin holds value for multiple reasons. The coin is currency recognized by a culture as a medium of transaction.

The coin holds aesthetic appeal. The coin is unique and holds numismatic value. But even if a fire disfigured your coin and all of these factors became mute, your coin would still hold the intrinsic value of the metal. For instance, I value a 1916-D Mercury Dime in a grade of Very Good at $1,000 because there were only 264,000 made. It is the key of this popular and beautiful set. If Visigoth the Coin Vandal took the 1916-D coin and disfigured it beyond the point of recognition, the dime would still hold roughly .07 ounces of silver for a value of roughly $0.50. In fact, that is about the value of the common coins of the series, minted in the millions, the melt value. Lets say that 1942 Batman comic was disfigured beyond the point of recognition, what would the value then remain. Or if the fire melted your Vermeer painting, or the government put a tax lien on your property, or the company in which you owned stock went out of business? Name a 1,000 year old company. Now look at a 1,000 year old coin.

Gold, like all commodities, proves a real yet volatile asset class. However, different than all other commodities, gold (and her little sisters silver and copper) have also performed as a store of wealth, a currency, and general measurement of value over many centuries. It is these qualities and their inherent complexities, sublime and subtle, that typically confuse the common man not well versed in monetary history, much less the hopeful yet naïve new investor searching for meaning and direction.

Gold served nobly as a store of value and measure of wealth, convertible into all other asset classes, for over 7,000 years. Hence all other asset classes, real or intangible, have been valued using this yardstick: how much gold will it buy or realize in trade? Silver and copper (and their myriad allows such as electrum, brass, bronze) have variously served in place of gold for lesser transactions The other precious white metals, platinum and palladium have served in such competency for a much shorter period of time.

Intrinsically, value only occurs when two people agree on the value. Nothing intrinsically has value. However, coins made of gold have value because the underlying commodity has value, irrespective of the denomination on the coin. This is unlike coins made of shells or beads which no longer have monetary value on any large scale. Paper currency has value only as long as those individuals who previously agrees on their value continue to agree on the value. In other words, paper (and the derivatives based on the paper) have no intrinsic value; value then becomes a confidence game. The confidence derives from the ability of the government issuing the paper to continue issuing paper.

This concept must be understood by potential investors. New investors often make the mistake of confusing underlying confidence in a commodity or currency and the short term confidence, a heady euphoria, that develops after a string of successful short term bets – especially those in a bull market. Inexperienced investors who lack ability and experience that develops through patient market analysis and repeated trading simply haven’t yet developed the tools to understand complex market, commodity, and currently relationships. They run headlong into common traps, therefore, set as a snare by some counter party market specialist, and throw money after a long run-up when the commodity reaches overbought conditions. And then the floor falls out of the price, over and over.

The pattern shows common for the average investor, doesn’t matter if the trade is a stock or commodity – the result is the same. The inexperienced trader waits and hedges and hems and haws until after the price move. The false short term confidence forces a new buy into a position. Shortly, invariably and inevitably the price declines and you once again recognize you bought a top rather than a trend.

Geopolitics

Whenever political or military showdowns first appear, gold will move. When a conflict of some type first appears inevitable, gold will move down. This is akin to the old maxim "buy the rumor and sell the news”.

Increasing Price of Silver and Gold Bullion

Expectation of an increase in silver value is a reason to buy junk silver. For instance, a junk 1964 silver quarter is always worth a minimum of 25c. When silver was around $4 the quarter was worth approximately 75cents. Now that same quarter is worth 1.75 without any increase in risk of holding the coin. Of course, the 1932-d quarter in mint state is not affected by an increase in bullion value because the numismatic value is at such a premium.

There is a psychological edge to the 'trend is your friend'. When prices are going up (or oversold) is when the majority of the population will actually begin buying the commodity. Nobody wanted silver when it was cheap because it wasn't fashionable, it had no visibility in the mainstream press, and even when the mainstream press did fun an article on it, the slant was decidedly bearish (because they were either incompetent or actively buying it - there are no other possibilities.)

Furthermore, a rise in one sector of a market often causes other sectors of the market to rise in sympathy.

Increasing Sophistication of Collectors and the Maturing Marketplace

With the advent of the internet collectors have practically unlimited access to unlimited information. This has created collector base that has increased sophistication over any other previous generation of collector. This sophistication, in turn, provides for a stronger market and allows stronger bids on quality coins since the collector realizes the scarcity of a high quality coin. The increasing sophistication of the market is also a significant development. For the collector who is either unable or unwilling to grade coins, or for the speculator who wants entry into the market but doesn't have the interest to develop hobby skills, the market now has a self-corrective mechanism with the advent of third party authentication and grading companies in the 1980s. The advent of the internet created real-time access to coins at any hour of the day or night throughout the world.

Additionally, the access to other market places increased dramatically. Previously, collectors either bought from their one or two local coins stores, (which could be an hours or more drive) or else took their chances with sight-unseen coins from the large dealers advertising in the numismatic periodicals.

Gold Price: 1981-2008

http://stockcharts.com/h-sc/ui?s=$GOLD&p=D&st=1970-01-29&id=p44306979429&a=147024720

You can root around here to find some middle-scale graphs, charts and comparisons:

http://www.historicalstatistics.org/

More Reasons to Buy Bullion Silver - Historic Values: Long Term Gold and Silver Ratios and Price Performance

Another way to look at precious metals' value is to compare the ratio to one another. The Gold:Silver ratio historically met at the average of 16:1. Now you know where the "Sixteen to One" mine got it's name from.

Gold versus Silver Ratio

Here is a nice rendition, the three-hundred year chart:

http://pricedingold.com/silver/

The best resource on the internet for financial graphs was developed by Sharefin. Here is his site. You have to subscribe now. Will take you a while to find everything.

A good place to start initially is with the first graph on this page (The 600 year silver chart):

http://cashinfo.org/wp-content/uploads/2009/10/600yearsilver.jpg

FWIW, I think this chart is actually incorrect in that the ratio for silver actually shows as too overweight during the middle ages based on other data I have seen (the 2,000 year charts). The comparison gets difficult because silver traded day to day as currency whereas Gold typically only exchanged hands for large land swaps or political deals.

Governments throughout the globe have attempted to fix the price of gold since government began. They actually achieved some success about 1,400 A.D. to ensure relative stability amongst economic pacts between each other. Silver had been allowed to float for many centuries (and thus become debased), whereas gold was only allowed to float beginning in 1973, more or less.

This silver devaluation trend continued even moreso after the Polosi Strikes by the Spanish in the Andes in the 1500s. Silver became the de-facto currency over most the trading world, and eventually the value was debased.

Here is a good study on the value of silver, as paid for working me wages, over the past 500 years (start on page 37):

http://www.economics.ox.ac.uk/Members/robert.allen/WagesFiles/wagesnew2.pdf

You can see silver became cheaper, compared to hours labor necessary to procure, after the precious metals strikes in California and Nevada in the mid 1800s.

Silver became so cheap, relatively, that the bankers could no longer make a profitable spread to suit their tastes. Hence, they engineered the panics and depressions of the 1890s and 1907. The US presidential election of 1896, to large degree, was based on the battle between whether Gold (Republicans) or Silver (Democrats) should be the coin of the US realm. Gold won.

Just ten years later the bankers were no longer satisfied with the Gold carry trade, and they instituted fiat currency via the 1907 panic and the resulting Federal Reserve Act six years later.

You can find some more long term price comparisons here (Long term Inflation in US and UK):

http://www.measuringworth.com/inflation/ and http://www.measuringworth.org/gold/

There are a few thousand gold/silver ratio and price performance charts that go back 30-100 years. There are a couple hundred good charts/graphs that go back to the middle ages.

Since I started looking in 1999 I have only seen five or six decent 2,000-4,000 year charts, and regrettably can’t locate at the moment of this writing.

Of course, most folks only have a two year time horizon anyway! LOL

MORE LONG TERM CHARTS

Long Term Metal Charts:

http://pricedingold.com/dow-jones-industrials/

More Reasons to Buy Bullion Gold:

Gold presented a series of buy signals during the four years of 1999-2002. These signals combined to form the major buy signal of your lifetime.

This view shows the value of metals priced irrespective of fiat currencies (Chart by Dabchick, chartist extraordinaire). Note that gold, silver, and platinum all began tight uptrend channels in 2002:

From: Dabchick, 2002

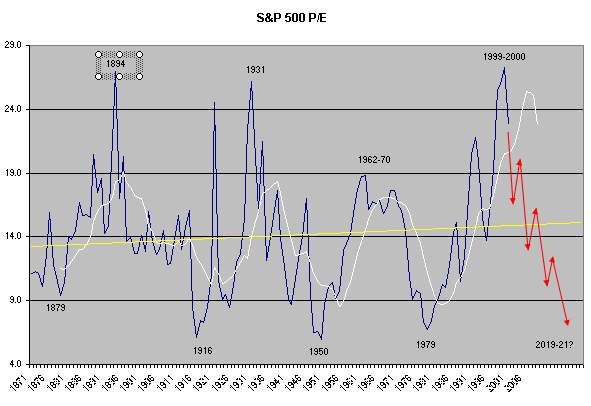

Price per Earnings multiple history of the Standard and Poor's 500 over the past 130 years.

Gold mining output peaked in 2001. Most the largest known reserves are playing out. We see no structural reason why this increasing shortage, and the inability of mines to satisfy increasing demand of the public and world governments will change.

Central banks became a net BUYER of gold in 2008 after having been a net seller of gold since the 1970s.

Why NOT Buy Diamonds?

Here is a starting primer:

http://www.theatlantic.com/magazine/print/1982/02/have-you-ever-tried-to-sell-a-diamond/4575/

|

Home Inventory

US Coins

Reference

Links

Blog

Finance

Paper

Metals

Mining

Shipping, Payments,Returns Follow us on Facebook or Twitter:

|